Not sure where to start when it comes to auto insurance? If y’all have a southern drawl, this insider guide to Alabama’s cheapest car insurance rates, best companies for certain age groups, and more is for you.

What Are You Looking For?

- Alabama’s Cheapest Companies

- How Much Drivers Like You Spend On Auto Insurance

- Specific City Rates

- Most Popular Alabama Car Insurance Providers

- Customer Satisfaction

- Our Recommendation

What Are Alabama’s Cheapest Car Insurance Companies?

We obtained rates from 20 top companies for five different driver profiles and analyzed the data to find that on average, drivers are paying roughly $2,028.51 a year for minimum liability insurance in Alabama. Should you pay that much? That depends on you, your driving history, and a number of other factors.

Read more: Top Choice For Alfa Insurance Reviews

We found Travelers, for example, to be 33% less expensive than the state average, based on annual premium data. Alfa Insurance and Safeco came in as a close second and third with rates more than $600 less than state average. Below is a chart that lists the cheapest to most expensive car insurance companies in the Heart of Dixie based on our research.

| Average Annual Rate | |

|---|---|

| Travelers | $1,348.97 |

| Alfa Insurance | $1,383.75 |

| Safeco | $1,423.69 |

| USAA | $1,525.42 |

| Farmers | $1,642.51 |

| State Farm | $1,797.73 |

| Country Insurance | $1,818.73 |

| Amtrust | $1,852.99 |

| Allstate | $1,880.10 |

| California Casualty | $1,890.90 |

| Infinity | $1,912.71 |

| Auto Owners | $1,937.23 |

| National General | $2,151.36 |

| Home State Insurance | $2,234.32 |

| ACCC | $2,273.22 |

| Titan | $2,372.07 |

| Progressive | $2,497.43 |

| Nationwide | $2,574.87 |

| Amica Mutual | $2,751.47 |

| GuideOne | $2,771.00 |

*While USAA is the 4th cheapest, it’s important to remember that it’s only available to military personnel and their immediate family members. If you’re not in a military family, you’ll need to get insurance quotes from other companies.

How Much Do Drivers Like You Spend On Auto Insurance?

We looked at the 27 most populated Alabama cities to find the cheapest car insurance providers by driver type. Because your rates can vary significantly by age, sex, and marital status, it’s important to know which car insurance companies are the cheapest for drivers like you. (For more information, read our “The Ultimate Guide To Auto Insurance In Alabama: Everything You Need To Know“).

Our data is based on several profiles with ages ranging from 18 to 65. Regardless of age or sex, our profiles use a driver who has one minor driving violation (such as a ticket), travels 15,000 miles a year, and has the minimum state liability coverage. Premiums can fluctuate depending on what car you drive, but we didn’t use a specific make or model. If you differ from this profile, your rates could change dramatically. This also doesn’t account for all the discounts that could be available to you.

Where Can You Find Cheap Car Insurance for Teens?

Insurance companies typically charge more for this age group because they statistically get into the most accidents. Teens don’t have the benefit of a clean driving record due partly to lack of experience.

In Alabama, our research found that ACCC Insurance and Farmers are the most affordable options for 18-year old teen drivers. If you are 18 and under, here’s what you might expect to pay for an annual policy from the five cheapest companies.

| Average Annual Rate | |

|---|---|

| ACCC Insurance | $2,376.83 |

| Farmers | $2,492.93 |

| Allstate | $2,974.78 |

| Alfa Insurance | $3,115.94 |

| USAA | $3,144.79 |

Where Can You Find Cheap Car Insurance for Single Drivers?

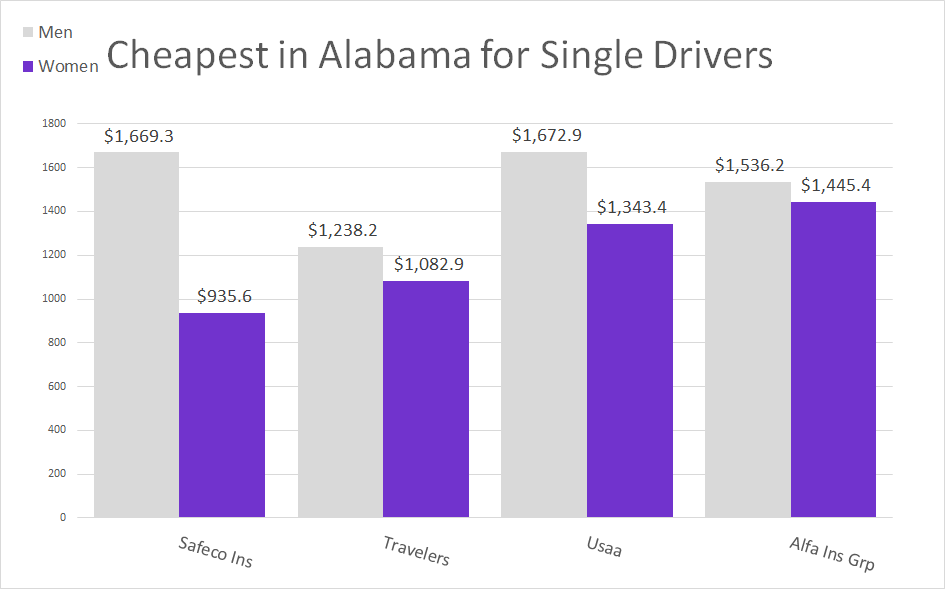

Our research shows that by the time you reach 25 your rates could have decreased 45% on average. Depending on your sex, you can pay drastically different rates. According to our calculations, women pay about 15% less than their male counterparts. Safeco, Travelers, USAA, and Alfa were the four cheapest for both men and women. See how your rates can differ:

Read more:

- Ultimate Guide To Affordable Auto Insurance In Alabama

- Alabama Car Insurance Requirements

What’s The Cheapest Auto Insurance Company for Drivers Over 55?

There are some perks to aging including paying less for car insurance. When analyzing rates for a married man and woman, age 62 and 57 respectively, we found that Safeco premiums are among the cheapest for Alabama drivers, with Travelers only $30 behind. This is based on average rates. Your annual premium could vary based on your unique driver profile.

| Alabama Car Insurance Companies | Average Annual Rate |

|---|---|

| Safeco | $924.64 |

| Travelers | $954.07 |

| Alfa Insurance | $1,215.07 |

| USAA | $1,220.04 |

| Country Insurance | $1,274.79 |

How Does City Affect Average Rates?

Rates can vary significantly throughout a state. For example, we found that there are only 143.4 miles separating the cheapest and most expensive cities, yet Ft. Payne drivers pay $671 more on average. That’s a $4.68 increase for every mile you drive. Below is the breakdown of insurance rates by city in Alabama.

| Average Annual Rate | |

|---|---|

| Florence | $2,023.73 |

| Ozark | $2,107.74 |

| Foley | $2,140.84 |

| Boaz | $2,158.68 |

| Russellville | $2,162.60 |

| Anniston | $2,169.11 |

| Bay Minette | $2,170.39 |

| Clanton | $2,183.84 |

| Alexander City | $2,185.85 |

| Daphne | $2,197.69 |

| Cullman | $2,202.90 |

| Andalusia | $2,209.12 |

| Jasper | $2,238.75 |

| Grove Hill | $2,242.56 |

| Eufaula | $2,243.56 |

| Citronelle | $2,307.35 |

| Troy | $2,308.31 |

| Dothan | $2,315.00 |

| Auburn | $2,344.73 |

| Huntsville | $2,356.14 |

| Gulf Shores | $2,361.87 |

| Tuscaloosa | $2,368.15 |

| Decatur | $2,371.14 |

| Birmingham | $2,408.20 |

| Montgomery | $2,430.46 |

| Mobile | $2,539.73 |

| Ft. Payne | $2,694.95 |

What Are The Most Popular Alabama Car Insurance Companies?

Market share shows the percentage of customers a company has compared to competitors. It can also show hidden insights about a company. We found that State Farm has the biggest market share in Alabama, but not the cheapest rates. The research helped us discover that Travelers (the cheapest option) ranks 10th for market share. This indicates that the majority of drivers in Alabama are choosing a company for other reasons than price such as customer service or coverage options. Take a look to see for yourself how price and market share relate to one another.

| Market Share % | Average Premiums | |

|---|---|---|

| State Farm | 24.61 | $2,702.47 |

| Alfa Insurance | 14.77 | $1,943.86 |

| Allstate | 10.94 | $2,750.62 |

| Geico | 9.49 | N/A |

| Progressive | 6.88 | $3,915.80 |

| USAA | 6.22 | $2,127.25 |

| Nationwide | 3.61 | $3,193.65 |

| Farmers | 2.91 | $1,917.50 |

| Liberty Mutual | 2.63 | N/A |

| Travelers | 2.26 | $2,191.62 |

**Prices for Geico and Liberty Mutual Insurance weren’t available on the Alabama DOI, so we didn’t include them here.

How Does Customer Satisfaction Rating Play into Auto Insurance?

A “complaint index” indicates the percentage of customer complaints compared to a company’s written premiums. It can tell you a lot about a provider’s overall customer satisfaction. The lower the numbers, the less complaints and better overall satisfaction. We found that Progressive has one of the lowest complaint indexes an indication its customers are happy in Alabama. Travelers is on the higher end and can be a sign of dissatisfied policyholders.

| Complaint Index | |

|---|---|

| Progressive | 0.02 |

| Allstate | 0.03 |

| Alfa Mutual | 0.03 |

| Geico | 0.04 |

| State Farm | 0.05 |

| USAA | 0.05 |

| Nationwide | 0.06 |

| Farmers | 0.08 |

| Liberty Mutual | 0.16 |

| Travelers | 0.21 |

A complaint index of 1.0 indicates that a company’s complaints are higher than average. You can see that the top 10 providers are well below state average.

What Do We Recommend?

The choice is up to you when it comes to deciding on an insurance company. Do the average rates decide who you go with, or does customer service matter more? Do you have poor credit, a less than clean driving record, or other factors that drive rates up? Don’t assume you can’t get affordable rates.

We want to help give you peace of mind by giving you the facts and our in-depth analysis. In Alabama, it depends what factor is the biggest priority in your decision:

- Budget– Our analysis discovered that Travelers is the cheapest across the board and Alfa Insurance is second.

- Popularity–If you want to go with the most popular auto insurance provider in Alabama, State Farm not only ranks number one, but has a pretty low complaint index too. Customers seem to have a good experience with routine questions and claims.

- Customer Satisfaction– Progressive has the lowest complaints in the state and is in the top five market share. Although, our data shows that their policies are much more expensive than others.

Depending on whether you’re farming in the country and barely driving or commuting to school in Auburn, you’ll need to call and get a quote to get an exact price. Call an agent at [mapi-phone /] and start comparing insurance policies.

Where We Found The Facts

All of the cost data we found is from The Alabama Department of Insurance. We analyzed it to help give you an idea of what drivers in Alabama pay for insurance, which companies they like best, and which providers are more suited for certain age groups. The key phrase there is “to give you an idea.” Every person is different and you shouldn’t expect your car insurance premium to be exactly what you see here. The information is provided solely for comparison purposes.

Source Links:

- Alabama Department of Insurance

- The National Association of Insurance Commissioners

- www.valuepenguin.com