We’ve done all the investigating for you to find the average cost of car insurance in Delaware—broken down by provider, driver type, and more. If you know the difference between North and South Delaware and have the accent to prove it, this is for you:

What Are You Looking For?

- Delaware’s Cheapest Companies

- How Much Drivers Like You Spend On Auto Insurance

- Specific City Rates

- Most Popular Delaware Car Insurance Companies

- Our Recommendation

What are Delaware’s cheapest companies?

After looking at 30 companies, seven cities, and five driver profiles, we found that the average Delaware premium is $1,291.27. Is that what you have to pay? Maybe not if you go with one of the 18 cheaper options! For example, Ocean Harbor, a company that specializes in coastal regions, offers rates that are 145% cheaper than the state’s average. According to our research, Goodville & German Insurance, Electric Insurance, California Management, and Allianz round out the top five most affordable.

| Average Annual Rate | |

|---|---|

| Ocean Harbor Insurance | $526.31 |

| Goodville & German | $706.59 |

| Electric Insurance | $865.62 |

| California Cas Mgmt | $902.97 |

| Allianz Insurance | $930.81 |

| Doctors Insurance | $933.06 |

| Metlife | $980.36 |

| American National Financial | $999.67 |

| Geico | $1,019.36 |

| Csaa Insurance | $1,019.86 |

| Palisades Insurance | $1,024.65 |

| Chubb Insurance | $1,052.39 |

| State Farm | $1,122.58 |

| Amica Mutual Insurance | $1,199.39 |

| Dairyland | $1,202.19 |

| Horace Mann | $1,230.98 |

| Nationwide | $1,249.17 |

| Kemper Corp Insurance | $1,287.33 |

| Travelers | $1,313.17 |

| Liberty Mutual | $1,348.09 |

| Main Street Amer Insurance | $1,353.67 |

| Donegal Insurance | $1,388.91 |

| Allstate Insurance | $1,469.06 |

| Progressive | $1,507.19 |

| Titan | $1,616.79 |

| Goodville & German | $1,643.92 |

| 21St Century | $1,658.61 |

| American Independent Insurance | $2,118.47 |

| Main Street Amer Insurance | $2,845.00 |

| The Hartford | $3,010.07 |

How much does the average driver spend on auto insurance?

Your nephew, Tim, might be 21 and already have three accidents under his belt. You, on the other hand, could be in your 30s with a kid and have a clean record. That’s why we looked at a bunch of different driver types and calculated what average auto premiums would be by driver type—because rates vary drastically depending on many factors.

Cheapest For Married Couples

We took an average from married couples who were 31, 43, and 65-years old. Here’s how much the average married couple could pay for auto coverage in Delaware, and how those rates compare to single drivers.

| Rates for Married Drivers | Rates for Single Drivers | |

|---|---|---|

| 21St Century | $1,752.31 | $1,623.48 |

| Allianz Insurance | $770.67 | $957.50 |

| Allstate Insurance | $2,431.77 | $1,108.04 |

| American Independent Insurance | $3,281.59 | $1,556.30 |

| American National Financial | $1,404.61 | $847.81 |

| Amica Mutual Insurance | $1,893.21 | $1,001.15 |

| California Cas Mgmt | $1,727.33 | $593.83 |

| Chubb Insurance | $2,256.41 | $543.00 |

| Csaa Insurance | $1,417.50 | $870.75 |

| Dairyland | $1,390.57 | $1,155.10 |

| Doctors Insurance | $1,288.00 | $755.58 |

| Donegal Insurance | $2,049.56 | $1,141.17 |

| Electric Insurance | $1,279.56 | $710.40 |

| Geico | $1,466.09 | $851.84 |

| Goodville & German | $552.40 | $728.00 |

| Goodville & German | $2,559.83 | $728.00 |

| Horace Mann | $1,051.62 | $1,288.05 |

| Kemper Corp Insurance | $2,640.22 | $780.00 |

| Liberty Mutual | $1,646.67 | $1,236.12 |

| Main Street Amer Insurance | $4,283.83 | $1,406.17 |

| Main Street Amer Insurance | $1,038.67 | $1,406.17 |

| Metlife | $1,713.78 | $705.33 |

| Nationwide | $1,661.96 | $1,094.38 |

| Ocean Harbor Insurance | $426.17 | $543.00 |

| Palisades Insurance | $936.10 | $1,113.20 |

| Progressive | $2,089.03 | $1,289.00 |

| State Farm | $774.17 | $1,180.65 |

| The Hartford | $3,147.63 | $2,939.83 |

| Titan | $2,262.11 | $1,374.79 |

| Travelers | $1,785.89 | $1,110.57 |

Read more: Allianz Auto Insurance

Cheapest For Drivers Under 25

You will most likely pay higher auto premiums as a younger driver because of statistics that show higher accident rates. There are some cheaper alternatives for you in Delaware though. After calculating the average rates for single 22 and 25-year-old men and women, we found that the companies with the lowest premiums are Ocean Harbor, Chubb, and California Casualty. These three companies average quotes are within $50 of each other, according to our analysis. Depending on your driving history, sex, and more these rates will vary.

| Average Annual Rates | |

|---|---|

| Ocean Harbor Insurance | $543.00 |

| Chubb Insurance | $543.00 |

| California Cas Mgmt | $593.83 |

| Metlife | $705.33 |

| Electric Insurance | $711.83 |

| Goodville & German | $728.00 |

| Doctors Insurance | $755.58 |

| Kemper Corp Insurance | $780.00 |

| American National Financial | $852.50 |

| Geico | $908.43 |

| Allianz Insurance | $957.50 |

| Csaa Insurance | $1,016.21 |

| Amica Mutual Insurance | $1,077.90 |

| Palisades Insurance | $1,113.20 |

| Allstate Insurance | $1,121.37 |

| Donegal Insurance | $1,141.17 |

| Dairyland | $1,150.32 |

| Travelers | $1,196.14 |

| Nationwide | $1,268.38 |

| Horace Mann | $1,313.55 |

| Liberty Mutual | $1,387.39 |

| Main Street Amer Insurance | $1,406.17 |

| Progressive | $1,427.79 |

| Titan | $1,510.33 |

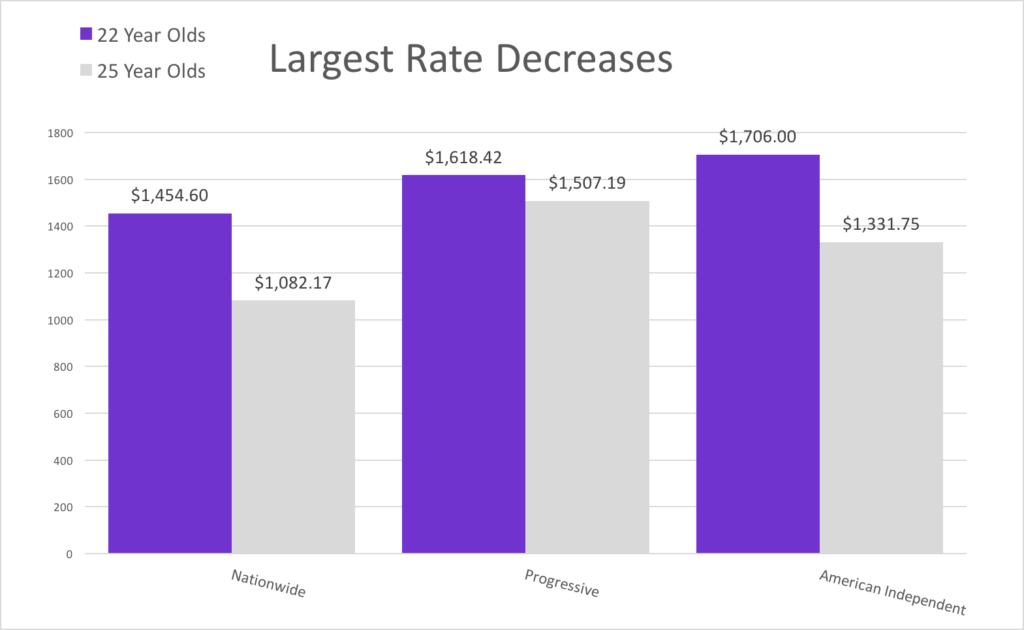

You should also note how much your rates can drop at the age of 25. While Delaware’s average rate drop is roughly 10% when looking at all companies, Nationwide, Progressive, and American Independent show decreases of 25%, 24% , and 22% respectively. This could be an indication that these companies may prefer not to write a policy for a younger driver that carries a potentially higher risk in that state.

Cheapest For Families With Teen Drivers

Have a kid who’s about to drive? Save yourself one more headache by checking out the average prices by carrier for auto policies. Plymouth Rock Assurance, formerly Palisades Insurance, comes in the cheapest with rates almost $200 cheaper than the second most affordable. Based on our study of families with parents who are 43 and 45 and have a teen, this is what you could expect to pay for auto coverage in Delaware.

| Average Annual Rates | |

|---|---|

| Plymouth Rock | $981.57 |

| Horace Mann | $1,139.15 |

| Electric Insurance | $2,042.17 |

| American National Financial | $2,195.33 |

| Geico | $2,373.11 |

| Nationwide | $2,618.33 |

| Csaa Insurance | $2,627.33 |

| 21St Century | $2,660.40 |

| Liberty Mutual | $2,896.56 |

| Travelers | $3,248.58 |

| Titan | $3,353.00 |

| Progressive | $3,434.33 |

| Metlife | $3,438.83 |

| Donegal Insurance | $3,575.50 |

| California Casualty | $3,801.33 |

Cheapest For Seniors

After looking at car insurance rates for married drivers over 65 with one car in the household, we found the cheapest to be Ocean Harbor Casualty Insurance, Chubb Insurance, and California Casualty Insurance. Here is the complete list of our calculations:

Annual cost of insurance by city?

Here’s another thing that will impact your premium: what city you live in. Look at the average cost in each city (according to our research) below:

| Average Annual Premium | |

|---|---|

| Middleton | $777.42 |

| Georgetown | $1,062.12 |

| Smyma | $1,110.78 |

| Dover | $1,164.02 |

| Middletown | $1,246.35 |

| Newark | $1,468.78 |

| Willmington | $1,657.52 |

What are the most popular Delaware and cheapest car insurance companies?

“Market share” shows a company’s popularity based on the number of customers it has compared to competitors. Why does it matter? Well, State Farm has the most customers out of any other auto insurer in Delaware, but it’s premiums are also nearly twice as much as cheaper providers and the company comes in 13th in the state for cheapest coverage.

What you should be asking here is, “why would the most customers go to a company that isn’t the cheapest?” It could be that it has better coverage and great customer service that’s making the price worthwhile. On the flipside, you won’t see any of the cheapest Delaware car insurance companies in the top market share chart. That could be because you get what you pay for and not that many customers like to go with a company that offers less—even when you pay less.

We’ll let you make up your own mind, but here are the top Delaware auto insurance companies based on market share according to our research:

| Market Share | Average Premium | |

|---|---|---|

| State Farm Insurance | 23.4 | $1,122.58 |

| Nationwide Corp Insurance | 16.64 | $1,249.17 |

| Geico | 14.03 | $1,019.36 |

| Liberty | 8.57 | $1,348.09 |

| Progressive Insurance | 7.82 | $1,507.19 |

| USAA | 6.81 | N/A |

| Allstate Insurance | 5.83 | $1,469.06 |

| Hartford Fire & Cas Insurance | 2.98 | $3,010.07 |

| Farmers Insurance | 2.6 | N/A |

| Travelers Insurance | 2.19 | $1,313.17 |

What do we recommend for the cheapest car insurance companies?

We’re here to lay out all the facts so you can make your own decision. If we’re sticking to that, then here’s what we would do in Delaware based on categories.

Cheapest Overall Coverage: Ocean Harbor

This is the cheapest insurance company in Delaware less than half of the state average. However, it doesn’t rank well in any other category which might warn you of poor customer service and coverage options.

Best Overall Scorer: Geico

Geico is the only insurance provider in Delaware that scores in the top 10 for both popularity and price. To us, that means that it has the customer base that should make you feel confident that it treats customers well and price that isn’t going to blow you out of the water.

Still not sure what to do? How about letting the experts help? You can call a licensed agent today to get help with your questions or shopping around for quotes.

Where We Found The Facts

We don’t make things up. We report the facts and just the facts. The only thing we guesstimate on are the state averages for auto insurance. Based on certain driver profiles and driving records, all the numbers here about cost are just a projection. It’s there to show you how much drivers like you could pay for auto coverage, so when you start shopping, you’ll have something to go on.

Source Links:

- Delaware Department of Insurance

- Census Bureau