Free Insurance Comparison Secured with SHA-256 Encryption Looking for affordable car insurance in the Peach State? If you have a southern drawl and root for the Braves, you’ve come to the right place. We’ve done the research on cheapest auto insurance near you, broken it down into driver profiles, and included information on the most popular insurance companies to choose from.

What Are You Looking For?

- Georgia’s Cheapest Companies

- How Much Drivers Like You Spend On Auto Insurance

- Specific City Rates

- Most Popular Car Insurance Companies in Georgia

- Customer Satisfaction Ratings

- Our Recommendation

What is the cheapest car insurance company in Georgia?

Out of 12 cities and six driver profiles, we found the average auto insurance policy cost for 56 Georgia car insurance companies. Our research shows that the cheapest car insurance rate for the average driver in Georgia is $809.03 with American National Financial, while the most expensive is $4,632.02 from Main Street American Group. Here are the least to most expensive insurance options for drivers based on our analysis.

| Average Annual Rate | |

|---|---|

| American National Financial | $809.03 |

| Shelter Insurance | $947.27 |

| Coast National Insurance | $1,086.24 |

| 21st Century | $1,126.10 |

| AIG | $1,302.83 |

| Georgia Farm Bureau | $1,335.53 |

| Ameriprise Financial | $1,337.95 |

| Country Insurance & Financial Services | $1,498.63 |

| The Hartford | $1,608.72 |

| Geico | $1,618.03 |

| USAA | $1,737.13 |

| National General | $1,752.82 |

| Safe Auto Insurance | $1,780.03 |

| Horace Mann | $1,835.09 |

| Auto Owners Group | $1,991.96 |

| Allstate | $2,036.87 |

| Farmers | $2,057.16 |

| Safeco | $2,075.62 |

| American Family | $2,100.70 |

| Brickstreet Mutual | $2,159.47 |

| Palisades | $2,204.22 |

| Cincinnati Insurance Co | $2,285.67 |

| Munic | $2,317.27 |

| QBE Insurance | $2,340.10 |

| Amtrust | $2,351.62 |

| Electric Insurance | $2,374.53 |

| Grange Mutual | $2,425.64 |

| ACE | $2,432.79 |

| California Casualty | $2,442.81 |

| Travelers | $2,641.91 |

| Alfa | $2,644.47 |

| Chubb | $2,657.80 |

| Central Mutual Insurance | $2,678.08 |

| Donegal Insurance | $2,697.10 |

| Liberty Mutual | $2,718.44 |

| State Farm | $2,775.49 |

| Progressive | $3,057.83 |

| Nationwide | $3,060.72 |

| State Auto Mutual | $3,063.53 |

| Safeway Insurance | $3,229.97 |

| Kemper | $3,290.39 |

| AssuranceAmerica I | $3,313.79 |

| Esurance | $3,594.29 |

| Amica Mutual | $3,636.33 |

| Automobile Club | $3,653.65 |

| Titan | $3,663.82 |

| American Independent Insurance Group | $3,726.39 |

| Everest Rein | $3,811.19 |

| Infinity | $3,836.71 |

| Charter Insurance | $3,968.25 |

| MGA | $4,040.53 |

| Access Insurance Company | $4,058.94 |

| Southern General Insurance | $4,249.54 |

| Insuremax | $4,328.78 |

| Hallmark Financial Services | $4,399.34 |

| Main Street America Group | $4,632.02 |

Read more: Providing Reliable Kemper Insurance Reviews

What are the average rates for auto insurance in Georgia?

Insurance companies price policies differently depending on age, gender, marital status, and more. That’s why we’ve gathered, calculated, and broken down insurance company quotes based on driver types so you can get a better idea of what you might pay and what is the cheapest option for you.

What is the cheapest car insurance company for men and women?

We’ve found that women across the country usually pay less than men for car insurance, but looking at the top three providers for both sexes, the data shows that men pay about 3% less in Georgia. This is only looking at gender– we looked at rates for female drivers age 19, 30, and 35 compared to male drivers age 19, 28, and 40. Because we know that older drivers typically pay less than younger drivers, this isn’t an apples to apples comparison. Use it as a rough estimate for what you might pay for the cheapest rates as a man or woman driver in Georgia.

Women’s Cheapest Auto Insurance

| Average Annual Rate | |

|---|---|

| American National Financial | $817.95 |

| Coast National Insurance | $992.86 |

| 21st Century | $1,243.24 |

| Shelter Insurance | $1,408.00 |

| Country Insurance & Financial Services | $1,425.29 |

| Ameriprise Financial | $1,435.00 |

| National General | $1,459.77 |

| AIG | $1,571.32 |

| Safe Auto Insurance | $1,649.55 |

| USAA | $1,654.75 |

| The Hartford | $1,671.03 |

| Geico | $1,704.06 |

| Safeco | $1,891.95 |

| Farmers | $1,905.58 |

| QBE Insurance | $1,958.14 |

| American Family | $2,055.15 |

| Brickstreet Mutual | $2,085.45 |

| Cincinnati Insurance | $2,108.30 |

| Amtrust | $2,206.95 |

| Electric Insurance | $2,223.33 |

Men’s Cheapest Auto Insurance

| Average Annual Rate | |

|---|---|

| American National Financial | $720.05 |

| Coast National Insurance | $1,042.09 |

| 21st Century | $1,116.95 |

| Electric Insurance | $1,204.09 |

| Ameriprise Financial | $1,299.23 |

| Georgia Farm Bureau | $1,335.53 |

| Automotible Club | $1,370.76 |

| AIG | $1,407.55 |

| Kemper | $1,510.92 |

| The Hartford | $1,513.89 |

| Geico | $1,584.86 |

| Horace Mann | $1,637.84 |

| National General | $1,674.18 |

| USAA | $1,676.39 |

| ACE | $1,685.58 |

| Palisades | $1,731.67 |

| State Auto Mutual | $1,817.50 |

| Farmers | $1,943.50 |

| Safe Auto Insurance | $2,014.79 |

| Allstate | $2,039.92 |

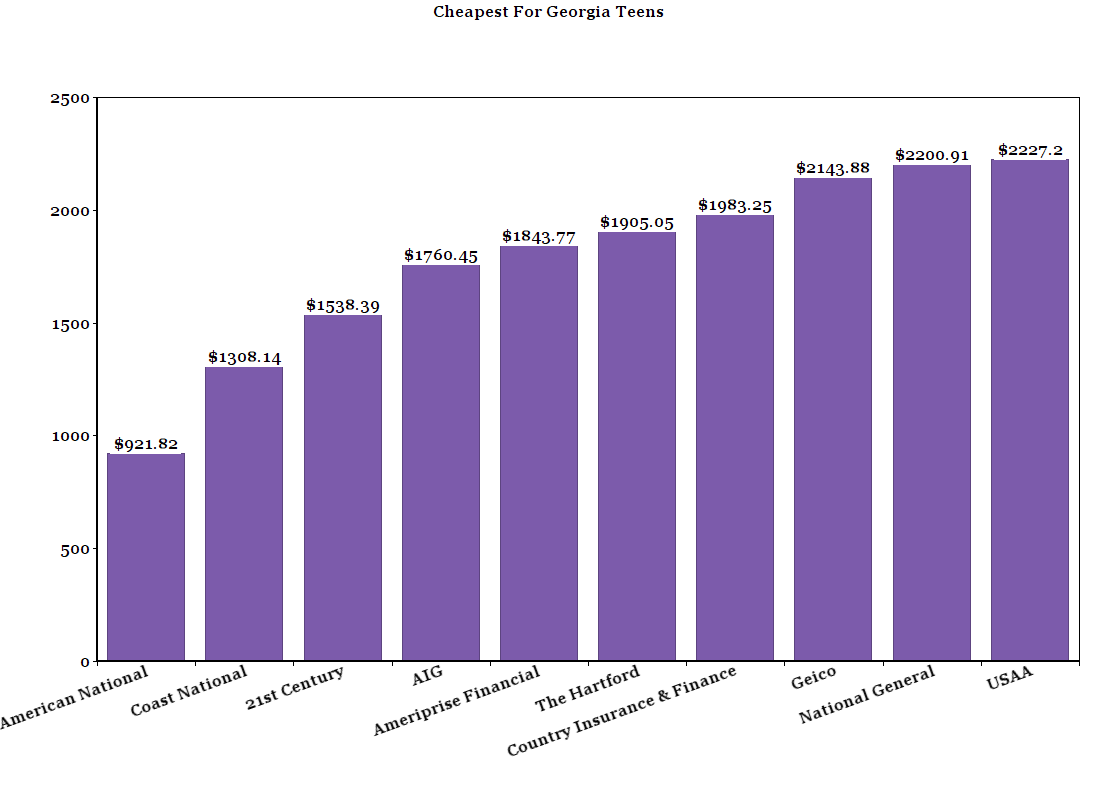

What is the cheapest auto insurance for Georgia teens?

We gathered and analyzed annual premiums for male and female 19-year olds with clean driving records. If you’re looking for cheap auto insurance policies for teens, American National, Coast National and 21st Century will be your most affordable coverage options. Here is the full cost analysis:

Whether you are a male or female driver can impact your rates as well. While American National, Coast National, 21st Century, and AIG are the four cheapest for both sexes, the premiums can vary significantly. Below you can see that Coast National has the biggest average car insurance rate difference when comparing the cheap car insurance for drivers who are the exact same–except for their sex.

Cheapest For People 65 And Older

After examining annual rates for a 65-year old married couple, we found that American National is the most affordable option—at almost $700 less than Farmers Insurance. Here are the 15 cheapest companies for retired drivers based on our findings:

| Average Annual Rate | |

|---|---|

| American National Financial | $338.18 |

| Shelter Insurance | $486.55 |

| 21st Century | $518.12 |

| Country Insurance & Financial Services | $529.40 |

| Coast National Insurance | $668.09 |

| Ameriprise Financial | $715.82 |

| The Hartford | $757.36 |

| AIG | $776.09 |

| Geico | $813.97 |

| Safeco | $855.95 |

| USAA | $859.48 |

| National General | $889.55 |

| QBE Insurance | $892.64 |

| American Family | $944.45 |

| Farmers | $954.60 |

*A senior-citizen discount was included in these rates.

What are the coverage costs of married drivers compared to single drivers?

Do married drivers get a price break on car insurance? According to our research, yes.

We used annual rate data from 19 and 35-year old single men and women to help evaluate which of the cheapest insurance companies provides the best auto insurance coverage for single drivers. Based on our research, American National is $370 cheaper than the next most affordable option.

Next, we looked at married drivers, age 28 and 65, and found that American National Financial and Country Insurance were the two cheapest auto insurance companies by almost $200. When we compared these rates to the rates of single drivers, our data concluded that some companies charge as much as 275% more for single drivers. Because our single driver cost analysis included driver profiles of teens, this could have played a part in the drastically increased rates.

| Married | Single | How Much More Single Drivers Pay | |

|---|---|---|---|

| 21st Century | $720.57 | $1,531.63 | 113% |

| AIG | $1,070.97 | $1,534.70 | 43% |

| American Family | $1,175.04 | $2,493.91 | 112% |

| American National Financial | $523.52 | $1,094.55 | 109% |

| Ameriprise Financial | $832.24 | $1,843.67 | 122% |

| Cincinnati Insurance | $1,176.39 | $2,456.20 | 109% |

| Coast National Insurance | $707.24 | $1,465.24 | 107% |

| Country Ins & Financial Services Grp | $529.40 | $1,983.25 | 275% |

| Geico | $1,034.69 | $2,201.37 | 113% |

| National General | $918.55 | $2,059.92 | 124% |

| Safe Auto Insurance | $1,066.52 | $2,587.09 | 143% |

| Safeco Insurance | $1,074.42 | $2,572.12 | 139% |

| Shelter | $947.27 | $2,315.16 | 144% |

| The Hartford | $1,105.70 | $2,111.73 | 91% |

| USAA | $1,022.45 | $2,451.81 | 140% |

What are the average car insurance rates per Georgia city?

Your age, gender, and marital status all impact your rates. So does where you live. See what the average cost of car insurance is per city in Georgia and compare them to your hometown’s average rates your neighbors in other cities are paying on average car insurance.

| Georgia Car Insurance Rates by City | Average Annual Rate |

|---|---|

| Whitfield | $2,223.29 |

| Ware County | $2,262.60 |

| Albany | $2,328.84 |

| Augusta | $2,374.98 |

| Columbus | $2,454.32 |

| Savannah | $2,485.83 |

| Marietta | $2,509.47 |

| Macon | $2,527.19 |

| Whitfield | $2,602.14 |

| Atlanta | $2,812.41 |

| College Park | $2,827.77 |

| Stone Mountain | $2,852.08 |

Read more: The Most Affordable Auto Insurance Options In Savannah

The cities of Columbus and Marietta are both unique for being large cities with relatively low insurance rates.

What are the most popular Georgia car insurance providers?

Market share shows the percentage of customers a company has compared to competitors. State Farm for instance, is Georgia’s number one seller of cheap car insurance based on the amount of customers it has in the state. Its average premium is also sky-high compared to other companies. That tells us that customers may be willing to pay more because of better service and more comprehensive coverage. Auto Owners is on the cheaper end of coverage, but has a really low market share. Again, this could be that you get what you pay for and customers in Georgia want more for their money.

We’ll let you decide what’s best for you, but here are the most popular auto insurance companies in Georgia based on market share:

| Market Share % | Average Premiums | |

|---|---|---|

| State Farm | 23.72 | $2,775.49 |

| Allstate | 11.57 | $2,036.87 |

| Progressive | 11.25 | $3,057.83 |

| Geico | 10.17 | $1,618.03 |

| USAA | 7.68 | $1,737.13 |

| Liberty Mutual | 4.89 | $2,718.44 |

| Nationwide | 3.61 | $3,060.72 |

| Georgia Farm Bureau | 3.3 | $1,335.53 |

| Travelers | 2.36 | $2,641.91 |

| Auto Owners Group | 1.95 | $1,991.96 |

Customer Satisfaction Ratings

When customers file a complaint, it goes into a “complaint index.” This shows the percentage of customers who complain about a company compared to its market share. The lower the number, the lower the ratio of complaints—and vice versa.

We discovered that Southern Farm Bureau has the state’s lowest complaint index while Liberty Mutual is much higher. That could lead you to believe that Southern Farm Bureau customers are more satisfied with their insurance provider than Liberty Mutual’s customers.

Below is how insurance companies in Georgia stack up when it comes to customer satisfaction.

| AM Best Rating | NAIC Complaint Index | |

|---|---|---|

| Southern Farm Bureau | A+ | 0.16 |

| State Farm | A++ | 0.43 |

| Geico | A++ | 0.61 |

| USAA | A++ | 0.75 |

| Allstate | A+ | 0.58 |

| Encompass | A+ | 0.84 |

| California Casualty | A- | 0.78 |

| Farmers Insurance | A | 0.82 |

| MetLife | A | 0.87 |

| Liberty Mutual | A | 0.98 |

Our Recommendation

We’re here to bring you all the facts needed to make a confident insurance purchase decision. Overall, Allstate, Geico, Liberty Mutual, State Farm, and USAA all scored in the top ten for most affordable policies, biggest popularity (market share), and best customer service (complaint index). Auto-Owners, Georgia Farm Bureau, Nationwide, Progressive, and Travelers are all close behind with top rankings in at least two of the categories.

Now you’ll need to determine what’s most important to you when it comes to auto insurance, but if you need a little help along the way, licensed insurance agents would be happy to talk to you. Not only can they help every driver from Atlanta to Savannah find auto coverage policies, but they can shop around for quotes and answer questions too. Call [mapi-phone /] to talk to an agent now.

Where We Found The Facts

Where We Found The Facts We troll the depths of the insurance company sea to find this data and bring it to you. We base our data off of premiums provided for real customer profiles and scenarios, but that doesn’t mean those scenarios will be your exact match. Remember, you as a driver are unique, so your actual rates might fluctuate from what you see here.

Source Links:

- Georgia Census Data

- The Georgia Office of Insurance and Safety Fire Commissioner

- valuepenguin.com