The Facts

Looking for auto insurance in Iowa? We have everything you need to know about where you might find the cheapest rates and which companies are most popular. If you’re used to the barrage of presidential candidates who invade your state every four years, have black dirt, and can see corn from horizon to horizon, this is the insurance page for you.

What Are You Looking For?

- Iowa’s Cheapest Companies

- How Much Drivers Like You Spend On Auto Insurance

- Specific City Rates

- Most Popular Iowa Car Insurance Companies

- Customer Satisfaction Ratings

- Our Recommendation

What are Iowa’s cheapest auto insurance companies?

Hey, Hawkeyes. Do you have an eagle eye for price tags? So do we. We looked at 20 cities, six companies, and eight driver profiles of people who drove a 2013 Honda Civic LX (4-door), had good credit, no accidents, and opted for standard coverage of 300/100/100, instead of Iowa minimums, to determine the average coverage rates for drivers in your state.

Our research shows that IMT Insurance, an Iowa based company that writes in only six states, comes in with the most affordable rates for auto policies. At almost $200 cheaper than Farmers, customers of IMT on average pay less than $50 a month for car insurance. The next most affordable, Farmers, Nationwide, and Allied, are all within $40 of each other, so depending on you your age, sex, driving history and more, any can be great options.

Since prices range from $575 to almost $2,000 based on the company, you’ll want to take a look at the full list for comparative purposes.

| Cheapest Insurance in Iowa | |

|---|---|

| IMT Insurance | $575 |

| Farmers | $741 |

| Nationwide | $767 |

| Allied | $785 |

| Pekin Insurance | $928 |

| Allstate | $1,072 |

| American Family | $1,081 |

| Farm Bureau Mutual | $1,092 |

| Geico | $1,227 |

| Grinnell Mutual | $1,301 |

| Travelers | $1,302 |

| Auto-Owners Insurance | $1,413 |

| EMC | $1,629 |

| Liberty Mutual | $1,932 |

Read more: Nationwide Vs AAA

How much do drivers like you spend on car insurance?

You’ll get a different rate as a single 40-year old than a 16-year old who just got his license. Check out the different driver profiles so you can get a better idea of what drivers like you spend on auto coverage in Iowa.

Cheapest For Teen Drivers

Pekin has the cheapest auto insurance premiums for teens. In fact, it charged all drivers the same average premium despite car or age. That’s unique since most all insurance companies charge much more for teens than other demographics. We found the rest of these average premiums by looking at driver profiles of men and women who were 18-years old. Here’s where you might find the cheapest rates as a teen driver.

| Cheapest for Teens | |

|---|---|

| Pekin Insurance | $921 |

| IMT Insurance | $1,147 |

| Farmers | $1,579 |

| Allied | $1,626 |

| Nationwide | $1,698 |

| Allstate | $1,995 |

| Farm Bureau Mutual | $2,012 |

| Geico | $2,238 |

| Grinnell Mutual | $2,280 |

| American Family | $2,635 |

| Liberty Mutual | $4,176 |

| Travelers | $4,633 |

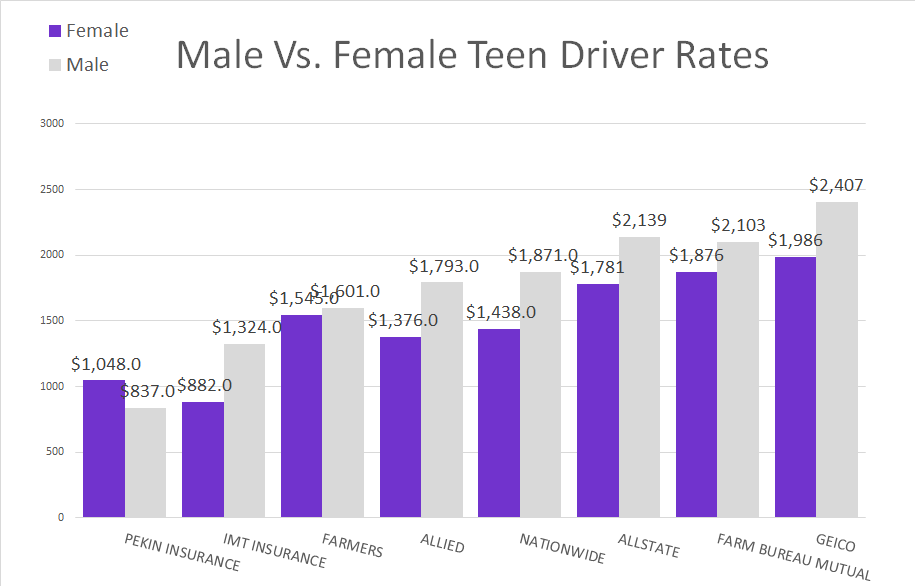

Female Vs Male Teenage Drivers

You just saw the average teen driver premiums, but they also vary depending on if you’re a boy or girl because rates are based on the amount of risk associated with writing a customer a policy. Our analysis shows that teen guys will pay about 24% more for car insurance in Iowa. Here is how rates compare between the two sexes.

Cheapest For Young Adults

Looking at 25-year old men and women, guys still end up paying more. are Check out the two charts below to see the average premium for young drivers and the comparison between men and women under 25.

| Cheapest for Young Adults | Average Annual Rate |

|---|---|

| IMT Insurance | $437 |

| Nationwide | $531 |

| Allied | $581 |

| Farmers | $596 |

| American Family | $607 |

| Allstate | $805 |

| Travelers | $819 |

| Farm Bureau Mutual | $898 |

| Pekin Insurance | $921 |

| Grinnell Mutual | $1,052 |

| Liberty Mutual | $1,189 |

| Geico | $1,244 |

| Auto-Owners Insurance | $1,685 |

| EMC | $2,242 |

IMT, Nationwide, and Allied are the cheapest regardless of sex, but that doesn’t mean rates are the same. Here are average premiums for the three most affordable companies broken down by gender.

| Female | Men | |

|---|---|---|

| IMT Insurance | $418 | $466 |

| Nationwide | $506 | $568 |

| Allied | $560 | $613 |

Where You’ll Find The Biggest Rate Cuts When You Turn 25

On your 25th birthday, you won’t have to wish for cheaper car insurance premiums. Your rates will drop about 56% from the time you were 18 if you’re a guy and 52% if you’re a girl. Here’s where you could find the most savings in Iowa:

| Men | Difference in Rate | Women | Difference in Rate |

|---|---|---|---|

| Liberty Mutual | -75% | Nationwide | -65% |

| American Family | -77% | American Family | -74% |

| Travelers | -83% | Travelers | -82% |

Cheapest For Drivers Over 40

As you get older, your rates tend to drop for auto coverage. Here’s the cheapest options we found for 40-year old married drivers in Iowa.

| Cheapest for Drivers 40 and Over | |

|---|---|

| IMT Insurance | $359 |

| Farmers | $394 |

| Nationwide | $420 |

| Allied | $466 |

| American Family | $541 |

| Travelers | $710 |

| Geico | $713 |

| Allstate | $727 |

| Farm Bureau Mutual | $730 |

| Pekin Insurance | $934 |

| Grinnell Mutual | $937 |

| Liberty Mutual | $1,181 |

| Auto-Owners Insurance | $1,278 |

| EMC | $1,402 |

What are the average rates in the city?

City slickers or rural dwellers in Iowa might find that their day-to-day lives are just as different as their car insurance rates. From Ames to Dubuque to Des Moines, you’ll pay a different premium sometimes hundreds of dollars different. Look at the chart below to see averages in your city.

| Cheapest Cities | |

|---|---|

| Ames | $953 |

| Iowa City | $1,004 |

| West Des Moines | $1,044 |

| Waterloo | $1,087 |

| Cedar Rapids | $1,112 |

| Dubuque | $1,113 |

| Des Moines | $1,172 |

| Davenport | $1,186 |

| Sioux City | $1,246 |

| Council Bluffs | $1,265 |

What are the most popular Iowa car insurance companies?

When we say “market share” you can think of it as a company’s popularity since it’s the percentage of customers it has compared to competitors. While popularity contests aren’t always based on legitimate information, looking at a company’s market share can tell you a lot about them.

IMT is the cheapest auto insurance provider in Iowa. It doesn’t have a very big market share though. That means people may be willing to pay more for a company’s service if it offers better value in customer service or coverage.

State Farm has Iowa’s biggest market share—almost a quarter of all insured drivers—and although we don’t know its average premiums, its usual rates in other states normally have the company closer to the fifth to tenth cheapest option.

| Most Popular | Customers | Market Share |

|---|---|---|

| State Farm | 322,272 | 21.68 |

| Progressive | 233,103 | 15.68 |

| Nationwide | 167,375 | 11.26 |

| Iowa Farm Bureau | 107,486 | 7.23 |

| American Family | 96,450 | 6.49 |

| Grinnell Mutual | 62,469 | 4.2 |

| IMT | 49,113 | 3.3 |

| Geico | 48,383 | 3.26 |

| Allstate | 44,975 | 3.03 |

| Auto-Owners Insurance | 30,605 | 2.06 |

It’s just something to consider when weighing the pros and cons of an insurance company. Pick one with a reasonably high market share and you’ll most likely be in good hands.

What companies have the most complaints?

A “complaint index” measures the percentage of customers who complain compared to its market share. Zero is a very good score. It means a very small percentage of customers have something bad to say. Number higher than 2.0 tend to be much worse, two times as bad as the national average to be exact. So be on the lookout for companies like Esurance and Victoria Insurance that have high complaint indexes in Iowa.

| Best Customer Service | Complaints | CPI | |

|---|---|---|---|

| IMT Group Insurance | $41,528,000 | 0 | 0 |

| Auto-Owners | $30,605,000 | 0 | 0 |

| Pekin Insurance | $24,166,000 | 0 | 0 |

| USAA | $24,010,000 | 0 | 0 |

| EMC Insurance | $19,012,000 | 0 | 0 |

| Iowa Mutual Insurance Company | $14,019,000 | 0 | 0 |

| Shelter | $13,449,000 | 0 | 0 |

| Dairyland | $11,902,000 | 0 | 0 |

| Country Financial Insurance | $10,220,000 | 0 | 0 |

| Grinnell Mutual Insurance | $62,470,000 | 1 | 0.5 |

| State Farm | $322,273,000 | 6 | 0.58 |

| Nationwide | $152,761,000 | 3 | 0.61 |

| Farm Bureau Mutual Insurance | $107,486,000 | 4 | 1.15 |

| Progressive | $233,103,000 | 9 | 1.2 |

| Geico | $48,383,000 | 2 | 1.28 |

| Farmers | $23,076,000 | 1 | 1.34 |

| Allstate | $38,398,000 | 2 | 1.61 |

| American Family | $95,815,000 | 5 | 1.62 |

| West Bend / Silver Lining Insurance | $27,293,000 | 2 | 2.27 |

| Liberty Mutual | $10,415,000 | 1 | 2.97 |

| AAA / Automobile Club | $9,753,000 | 1 | 3.17 |

| Safeco | $11,562,000 | 2 | 5.36 |

| Victoria Insurance | $5,008,000 | 1 | 6.18 |

| Esurance | $6,500,000 | 3 | 14.29 |

Read more: Dairyland Auto Insurance

What do we recommend?

We’re flattered you want our opinion on the matter, but we’re not here to tell you what to do. We want to give you all the data, facts, and figures you need to make a decision based on your own needs and life.

The one thing we do always tell our readers though is that when you’re deciding on an auto insurance provider, you should pick one that scores well in multiple categories. IMT, Nationwide, and Pekin Insurance all ranked in the top five for market share, complaint index, or price, but this all means something different.

While Nationwide’s customer complaint index was above zero, it still came in around average for that. Pekin Insurance also didn’t rank in the top 10 for popularity, but did well for cost and low customer complaints. The same goes for IMT. It ranked number seven for market share and only sell to a small portion of Iowa drivers, but it’s the cheapest provider and one of the best for complaint index.

This is where it comes down to your preference. Are you looking for budget-friendly or customer service champions? Don’t limit your options down to just the cheapest car insurance companies or even the largest car insurance companies. We suggest you find a company that’s pretty good with price, popularity, and customer service. That way you’ll end up with a well-rounded provider.

You should also look into which providers offer auto insurance discounts that you are eligible for. Many companies offer discounts for bundling auto insurance coverage with a homeowners insurance or life insurance policy. There may also be discounts for taking a defensive driving course or for choosing paperless billing and automatic payments. If you have a high insurance rate due to a poor credit score or a bad driving record, there are a variety of discounts that can help you secure affordable car insurance.

Where We Found The Facts

This is a true story. Well, for some people. While all the facts here came from credible sources after lots of double and triple checking, the premiums might not be what you get when you call for a quote. This information is provided solely as a way to give you an idea of what average drivers pay for auto insurance coverage in Iowa. Since we used profiles of eight drivers who drove a 2013 Honda Civic LX (4-door), had good credit, and clean driving records for our sample rates, you might get a different price if this doesn’t match your profile exactly.

Source Links:

- ratekick.com

- valuepenguin.com