We’re here to make your life easier by bringing you relevant car insurance information you can understand. If you say, “Naw-lins” and know how to throw a serious crawfish boil, this is the Louisiana car insurance information you want to know from cost of cheapest providers to which provider is best for certain drivers and more.

Louisiana’s minimum requirements for car insurance include property damage liability and bodily injury liability coverage, but you should also think about additional coverages like collision insurance and comprehensive insurance so that your own vehicle is covered for any possible scenario. Liability insurance only pays for the other driver’s damages when an accident is your fault. You might also consider adding uninsured/underinsured motorist coverage, which pays for your damages when you’re in an accident with an uninsured motorist or someone who does not have enough insurance to cover all of the costs of the accident.

What Are You Looking For?

- Cheapest Companies In Louisiana

- How Much Drivers Like You Spend On Auto Insurance

- Specific City Rates

- Most Popular Louisiana Car Insurance Companies

- Customer Satisfaction Ratings

- Our Recommendation

Cheapest Louisiana Companies

We calculated average premiums for 51 Louisiana auto insurance providers by taking information from seven driver profiles and 14 Louisiana cities. Here are the average prices from cheapest to priciest:

| Cheapest Car Insurance in Companies | Average Annual Premium |

|---|---|

| Pharmacists Mutual | $1,202.45 |

| ACE | $1,268.31 |

| John Deere Insurance | $1,331.15 |

| Geico | $1,347.65 |

| AssuranceAmerica | $1,370.60 |

| Horace Mann | $1,372.36 |

| USAA | $1,376.79 |

| Louisiana Farm Bureau | $1,398.41 |

| Insura Property & Casualty Insurance | $1,400.35 |

| Hallmark Financial Services | $1,416.92 |

| The Hartford | $1,441.08 |

| RLI Insurance | $1,443.46 |

| AIG | $1,477.58 |

| Liberty Mutual | $1,495.35 |

| American National Financial | $1,523.70 |

| American Independent Insurance | $1,525.47 |

| Direct General | $1,549.15 |

| Cornerstone National | $1,579.03 |

| Safeco | $1,579.41 |

| Progressive | $1,582.49 |

| Affirmative | $1,594.12 |

| State Farm | $1,603.74 |

| State National | $1,603.87 |

| National Security | $1,609.96 |

| Auto Club Enterprises | $1,624.38 |

| Maiden Holdings | $1,625.01 |

| Hanover Insurance | $1,627.29 |

| Safe Auto Insurance | $1,632.74 |

| Palisades | $1,652.74 |

| MetLife | $1,659.78 |

| California Casualty | $1,664.52 |

| Access Insurance Company | $1,676.13 |

| Kemper | $1,680.47 |

| 21st Century | $1,706.16 |

| Allstate | $1,724.49 |

| American Family | $1,784.88 |

| Home State Insurance | $1,810.84 |

| Foremost Insurance | $1,843.05 |

| National General | $1,861.07 |

| Esurance | $1,862.36 |

| Amtrust | $1,862.57 |

| Amica Mutual | $1,890.65 |

| Tiptree | $1,914.76 |

| Shelter Insurance | $1,934.34 |

| GoAuto Insurance | $1,936.19 |

| Hallmark Financial Services | $1,975.24 |

| Safeway Insurance | $1,987.14 |

| Allianz Insurance | $2,016.47 |

| Chubb | $2,019.36 |

| Imperial Fire & Casualty | $2,111.47 |

| La Auto Insurance Plan | $2,404.57 |

Read more:

- Steps To Take After A Hit-And-Run Incident In Louisiana

- Top Tips To Find The Most Affordable Auto Insurance In Louisiana

If you’re looking for cheap car insurance, Pharmacists Mutual and ACE look like good prospects, but there’s more to consider than just which company has the lowest rate.

How much do drivers like you spend on auto insurance?

We analyzed more specific groups of drivers so you’ll have a better understanding of what you could pay for coverage near you.

Cheapest For Teen Drivers

After looking at data for teen drivers, we found the cheapest options for you.

| Cheapest for Teens | Average Annual Cost |

|---|---|

| National Security | $3,212.35 |

| American Independent Insurance | $3,215.06 |

| GoAuto Insurance | $3,220.33 |

| Hallmark Financial Services | $3,226.11 |

| Safeco | $3,232.59 |

| MetLife | $3,248.24 |

| ACE | $3,256.00 |

| LA Auto Insurance Plan | $3,257.22 |

| 21st Century | $3,259.12 |

| Access Insurance Company | $3,262.24 |

Cheapest For Teens by Gender

If you’re 18, female, and driving in Louisiana, you’ll pay about 9% less than your guy friends. Here are the cheapest options for you based on our research:

| Cheapest for Teen Women | |

|---|---|

| Safeco | $2,690.00 |

| Palisades | $2,764.40 |

| Progressive | $2,961.29 |

| Auto Club Enterprises | $2,966.00 |

| AssuranceAmerica | $3,008.00 |

| Cheapest for Teen Men | |

|---|---|

| Hallmark Financial | $2,803.25 |

| Imperial | $3,002.75 |

| Insura | $3,008.50 |

| Access Insurance | $3,258.25 |

| Amica Mutual | $3,296.00 |

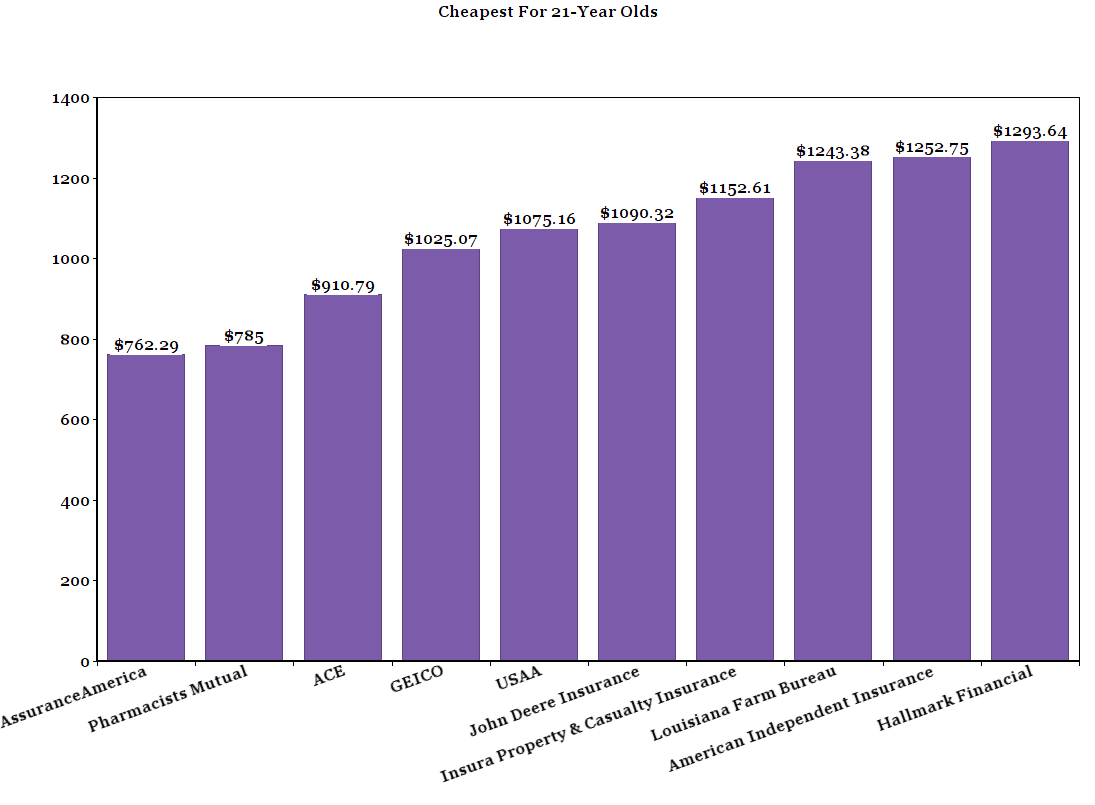

Cheapest For 21-Year Olds

You’ll be happy to see that from your 18th birthday to now, your rates will have dropped about 48%. That is because the older you get, the less of a risk insurance companies perceive you to be. Typically, you will see the biggest decrease in your rates when you turn 25–especially if you are a guy. Check it out:

Cheapest For Drivers Over 60

Based on our findings, there are 27 car insurance companies in Louisiana that offer auto insurance policies under $1,000 annually for both men and women over 60. Take a look.

| Best For Drivers Age 21 | Average Annual Cost |

|---|---|

| La Auto InsurancePlan | $901.50 |

| Allianz Insurance | $910.16 |

| GoAuto Insurance | $911.50 |

| Hallmark Financial Services | $914.83 |

| AssuranceAmerica | $916.31 |

| National Security | $919.33 |

| American Independent Insurance | $920.67 |

| Auto Club Enterprises | $921.23 |

| California Casualty | $922.31 |

| Safeco | $933.83 |

| Esurance | $934.15 |

| The Hartford | $944.00 |

| Chubb | $944.69 |

| MetLife | $948.80 |

| 21st Century | $949.25 |

| Access Insurance Company | $951.00 |

| AIG | $953.83 |

| Amica Mutual | $964.00 |

| Louisiana Farm Bureau | $968.00 |

| State Farm | $973.60 |

| Maiden Holdings | $977.38 |

| Kemper Corporation | $980.38 |

| Amtrust | $982.62 |

| National General | $984.31 |

| Cornerstone National Insurance | $994.57 |

| Direct General | $996.29 |

| Safe Auto Insurance | $999.54 |

Read more: Allianz Auto Insurance

Cheapest For Women

According to our data analysis, women spend 13% more on car insurance than their male peers. Here are the cheapest options out there for you in Louisiana:

| Most Affordable for Women | Average Annual Cost |

|---|---|

| AssuranceAmerica Insurance | $1,276.65 |

| ACE | $1,289.96 |

| Horace Mann | $1,295.13 |

| Pharmacists Mutual | $1,300.00 |

| Geico | $1,338.26 |

| Louisiana Farm Bureau | $1,370.90 |

| Hallmark Financial Services | $1,387.35 |

| Palisades | $1,391.70 |

| The Hartford | $1,396.19 |

| Liberty Mutual | $1,421.63 |

| RLI Insurance | $1,456.92 |

| John Deere Insurance | $1,469.32 |

| Auto Club Enterprises | $1,499.87 |

| USAA | $1,505.55 |

| Progressive | $1,509.81 |

Cheapest For Men

Men pay about 13% less for car insurance than women in Louisiana. Here’s where you’ll find the cheapest coverage:

| Most Affordable for Men | Average Annual Cost |

|---|---|

| Pharmacists Mutual | $1,048.73 |

| Insura Property & Casualty Insurance | $1,083.00 |

| John Deere | $1,102.31 |

| USAA | $1,175.42 |

| ACE | $1,237.37 |

| Geico | $1,360.09 |

| AIG | $1,384.39 |

| State National | $1,410.45 |

| RLI Insurance | $1,421.16 |

| American Independent Insurance | $1,428.06 |

| Louisiana Farm Bureau | $1,439.46 |

| Maiden Holdings | $1,459.91 |

| Hallmark Financial Services | $1,461.26 |

| Horace Mann | $1,474.64 |

| American National Financial | $1,486.44 |

City Rates

Whether you’re listening to jazz in New Orleans or relaxing on the bayou, you’ll pay a different price for car insurance. Check out the differences we’ve found below so you know what to expect when you call around for quotes.

| Cheapest Cities for Car Insurance | Average Annual Premium |

|---|---|

| Shreveport | $1,522.55 |

| Monroe | $1,559.36 |

| Lake Charles | $1,587.80 |

| Alexandria | $1,591.34 |

| Slidell | $1,594.89 |

| Hammond | $1,600.02 |

| Baton Rouge | $1,600.73 |

| Batchelor | $1,606.41 |

| Houma | $1,617.11 |

| Lafayette | $1,631.48 |

| Metairie | $1,715.45 |

| New Iberia | $1,743.02 |

| New Orleans | $1,756.74 |

| Chalmette | $1,788.47 |

Some of Louisiana’s largest cities are also its most expensive for car insurance, with New Orleans second most expensive, and Baton Rouge and Lafayette not far behind.

In addition to age, gender, and location, your auto insurance rate is also determined by your driving record and credit score. If you’re having trouble finding cheap auto insurance because of poor credit or a bad driving record, make sure to ask about any insurance discounts you might be entitled to. Auto insurance companies offer discounts for setting up automatic payments, or enrolling in a usage-based insurance program. These programs use a mobile app on your phone to monitor your driving habits and give you a discount for safe driving. You might also find companies with loyalty discounts or discounts for drivers who are in the military.

Sometimes finding the cheapest rates comes down to which companies offer the best discounts.

What are the most popular Louisiana car insurance providers?

One way to measure a company’s “popularity” is to look at its “market share.” This shows you how many customers a company has compared to competitors. In Louisiana, State Farm is king with about one third of the state’s insured drivers on their policies. Their prices are the 22nd cheapest though meaning customers are paying more for their policies. Pharmacist Mutual Insurance is the cheapest in Louisiana, but it didn’t even make the top 10 for market share.

This is where reading about market share becomes valuable because it can show you that more people may be paying for service because of better coverage or customer service. Take a look.

| Market Share Percentage | Average Annual Rate | |

|---|---|---|

| State Farm | 32.92 | $1,603.74 |

| Progressive | 13.26 | $1,582.49 |

| Allstate | 12.18 | $1,724.49 |

| Geico | 8.63 | $1,347.65 |

| Liberty Mutual | 5.38 | $1,495.35 |

| Southern Farm Bureau Casualty | 5.22 | N/A |

| USAA | 4.82 | N/A |

| Affirmative Insurance | 3.35 | $1,594.12 |

| GoAuto Insurance | 1.67 | $1,936.19 |

| Amtrust | 1.58 | $1,862.57 |

Which auto insurance companies have the best customer service?

Every time a customer complains, it goes into what’s called a “complaint index.” That document tells you how many customer complaints a company receives compared to its market share. The lower the number, the less complaints. The less complaints, the happier customers probably are.

| Complaint Index | ||

|---|---|---|

| Liberty Mutual | 0 | |

| Louisiana Farm Bureau | 0 | |

| Progressive | 0.27 | |

| Safeco | 0.32 | |

| State Farm | 0.39 | |

| Allstate | 0.4 | |

| Geico | 0.4 | |

| Safeway | 0.42 | |

| USAA | 0.74 | |

| Goauto Properties | 0.81 | |

| Shelter | 1.14 | |

| Affirmative Insurance | 3.96 |

When you’re looking for an insurance provider, you shouldn’t just look at price. Make sure they’re keeping customers happy too by doing for one like Liberty Mutual or Louisiana Farm bureau that have zero complaint indexes compared to Affirmative Insurance which is pushing it with the amount of negative feedback they get.

What do we recommend?

We’re here to give you all the information you need to make a smart insurance decision, but the choice is ultimately up to you. If we were going on all-around great scores, we’d choose Allstate because it ranked in the top ten for price, complaint index, and market share. Affirmative Insurance did too, but their complaint index is a bit higher than we’d like to see.

If you need help, you can talk to a team of insurance agents who can answer questions and shop around for auto insurance quotes. All you Saints-fans have to do is call [mapi-phone /] to talk to one now.

Where We Found The Facts

All our facts are bonafide (check out the links below to see for yourself), but our average rates are based on very specific driver profiles meaning they might not be true for you. We wanted to give you all an idea of what to expect when you shop for auto quotes, but in order to get an accurate number, you’ll have to call so agents can tailor it to you and only you!

Source Links:

- Louisiana Census Data

- Louisiana Department of Insurance

- Complaint Index