Wondering where you can find the most affordable auto insurance? We have it all here from cheapest insurance companies to average rates by driver type and more! You’ll find all the car insurance premium information for Maine drivers in this all inclusive guide.

Maine has minimum coverage requirements to drive legally in the state. These include bodily injury liability coverage, property damage liability coverage, and uninsured/underinsured motorist coverage. Liability insurance only covers the other party’s damages in an accident that you cause. To have your own damages covered, it’s highly recommended that you add collision insurance and comprehensive insurance to your auto policy.

What Are You Looking For?

- Cheapest Companies In Maine

- How Much Drivers Like You Spend On Auto Insurance

- Specific City Rates

- Most Popular Car Insurance Companies In Maine

- Customer Satisfaction Ratings

- Our Recommendation

What are the cheapest auto insurance companies in Maine?

We looked at 10 cities, seven companies, and eight driver profiles for people who drove a 2013 Honda Civic LX (4-door) with good credit and no accidents to come up with these quotes by insurance company. The average is about $1,400 a year, but you could pay as little as $930 with Travelers. Allstate comes in as the second most affordable in our analysis with rates almost $600 cheaper than the third least expensive, Geico. According to our research, here is how the most affordable companies stack up.

| Average Annual Rate | |

|---|---|

| Travelers | $932.65 |

| Allstate | $966.35 |

| Geico | $1,223.85 |

| OneBeacon | $1,345.35 |

| Liberty Mutual | $1,504.30 |

| Concord | $1,904.40 |

| MetLife | $2,528.40 |

How much do drivers like you spend on auto insurance?

Would you want to pay as much for auto insurance as a 40-year old married woman as a teenage driver who just got her license? Probably not. Insurance companies use a ton of personal information to calculate premiums, so you can get a much better idea of what you should be paying if you look at categories of drivers like you.

Cheapest For Teens

Teens pay the highest rates for auto insurance because they lack driving experience. Teens can find the cheapest coverage with Allstate (on average) in Maine. The list below features all of the cheap car insurance companies for teen drivers. (For more information, read our “How to Get Cheap Car Insurance for Teens and Their Parents“).

| Average Annual Rate | |

|---|---|

| Allstate | $1,805.00 |

| Travelers | $2,441.60 |

| OneBeacon | $2,486.00 |

| Geico | $2,817.40 |

| Liberty Mutual | $3,270.20 |

| Concord | $3,769.00 |

| MetLife | $4,223.20 |

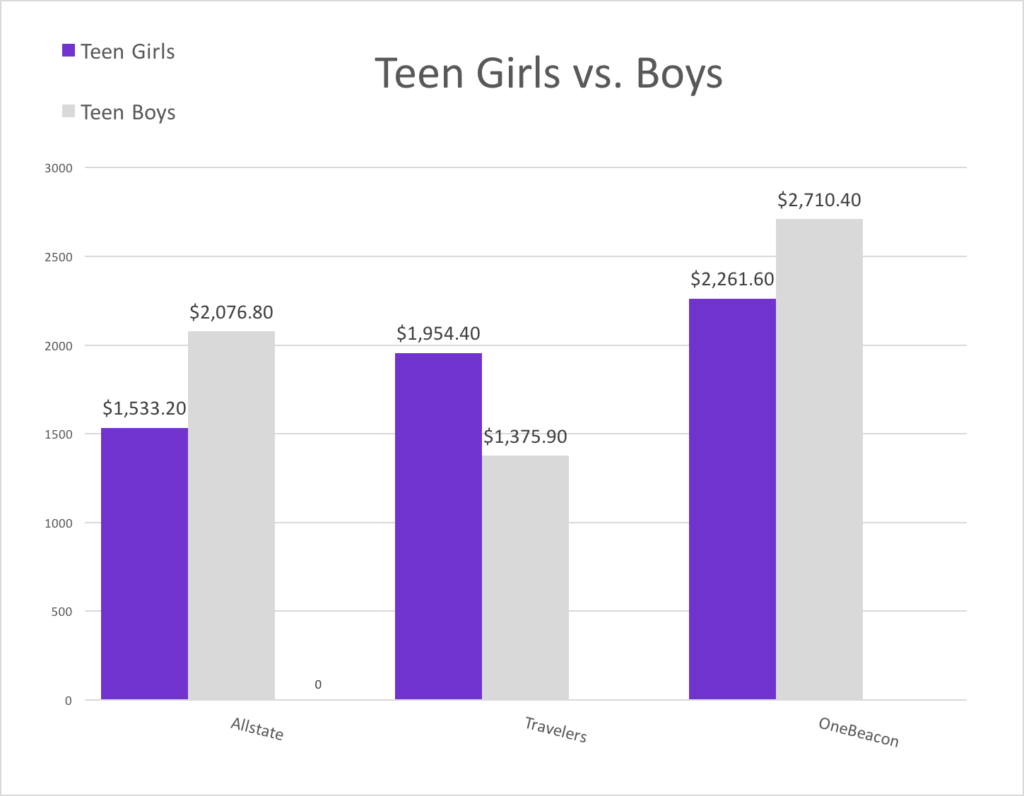

Male Teens Vs Female Teens

You just saw a bunch of averages for teen drivers. Now, we’ll break it down by sex so you can get an even more accurate projection of what you could pay for auto insurance in Maine. Our research shows that teen boys pay 24% more than teenage girls, even though both sexes can find the cheapest rates through Allstate, OneBeacon, and Travelers. Here are average quotes for the three most affordable by gender:

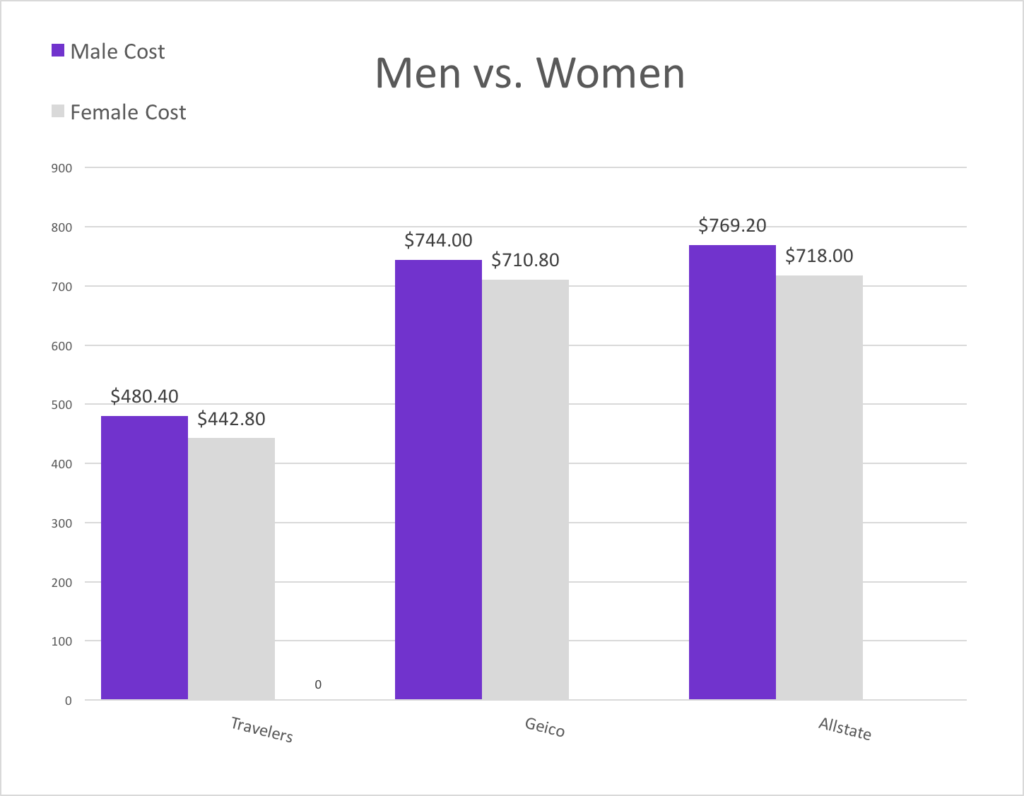

Cheapest For Young Adults

Your rates for car insurance could drop about 69% in Maine between your 18th and 25th birthdays. Travelers, Geico, and Allstate are the cheapest for male and female drivers under 25 too. After looking at profiles of 25-year old men and women, here are the cheapest rates for this age group and the differences between what men and women pay for auto coverage.

| Average Annual Rate | |

|---|---|

| Travelers | $461.60 |

| Geico | $727.40 |

| Allstate | $743.60 |

| MetLife | $833.60 |

| Liberty Mutual | $1,196.40 |

| OneBeacon | $1,243.80 |

| Concord | $1,435.20 |

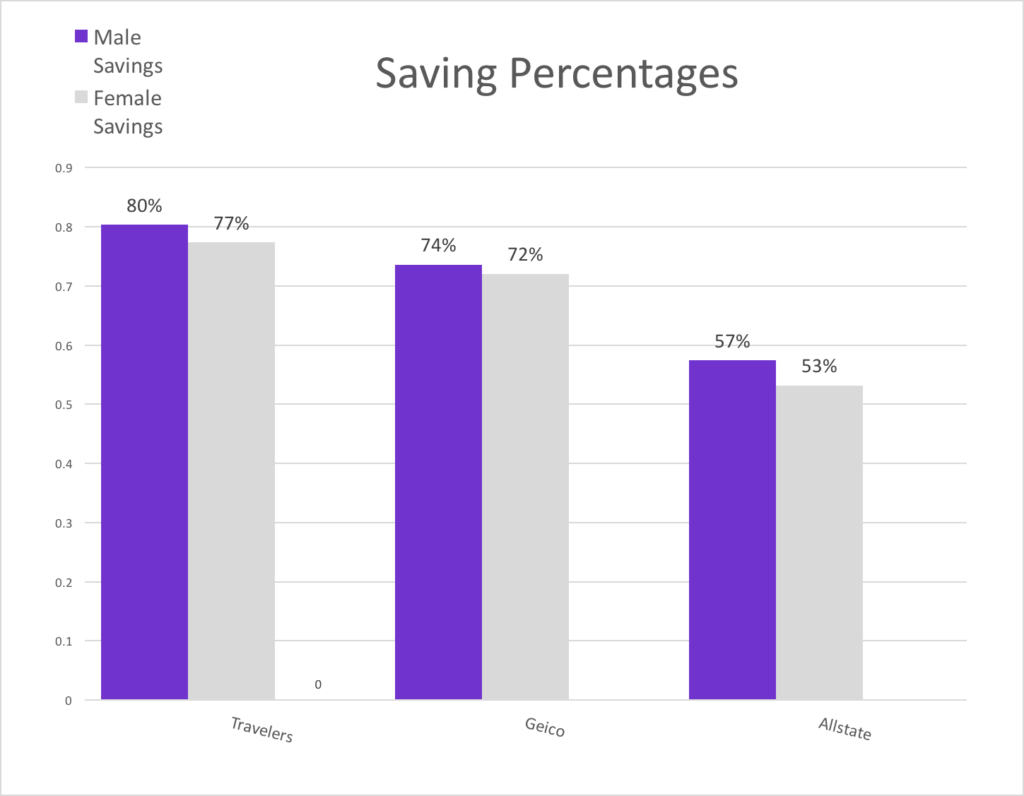

Companies With The Biggest Drops Between 18 and 25

Expect to see some big chunks of change falling off your auto premiums between 18 and 25. Based on our research, you can save 50% to 80% if you stick with Travelers, Geico, or Allstate. Here is how much you may save with each when you turn 25.

In addition to age, auto insurance providers consider factors like your driving record and credit score when assigning insurance rates. If you have a poor credit history or a bad driving record, you may be able to lower your annual premium with insurance discounts. Many insurance companies offer discounts for bundling your auto insurance policy with a homeowners insurance or life insurance policy. Some companies also offer a discount for taking a defensive driving class or setting up automatic payments and paperless billing. There are a wide variety of insurance discounts, so make sure to ask about them when you are comparison shopping for quotes.

How much are auto insurance rates in the city?

You’ll also pay a different rate depending on where you live in The Pine Tree State. Take Saco and Auburn for instance. They’re only about an hour apart, but you’ll pay almost $300 more a year for auto coverage in Auburn, Maine. See for yourself what your fellow Mainers are paying depending on their addresses with our research below.

| Average Annual Rate | |

|---|---|

| Saco | $1,286.00 |

| South Portland | $1,300.54 |

| Brunswick | $1,307.62 |

| Biddeford | $1,308.85 |

| Lewiston | $1,390.08 |

| Scarborough | $1,422.92 |

| Bangor | $1,480.38 |

| Stanford | $1,486.15 |

| Portland | $1,532.92 |

| Auburn | $1,547.77 |

What are the most popular Maine auto insurance providers?

What we call “market share” you can think of as popularity. It means the percentage of customers a company has compared to competitors. It can actually tell you a lot about a company by looking at it.

State Farm is Maine’s most popular auto insurance provider and has the most customers out of any other company. It’s not listed as one of the cheapest providers, but it does score well in the section after this that talks about customer satisfaction. When looking at a company and its market share, pay close attention. Usually people flock to certain companies because of service and coverage, but not always price. It’s just something to keep in mind when you’re shopping for auto coverage in Maine.

| Most Popular | Premiums Written | Market Share |

|---|---|---|

| State Farm | 87,585 | 13.83 |

| Progressive | 87,119 | 13.75 |

| Liberty Mutual | 60,499 | 9.55 |

| Geico | 55,108 | 8.7 |

| Allstate | 50,437 | 7.96 |

| Concord | 32,415 | 5.12 |

| USAA | 25,667 | 4.05 |

| MetLife | 23,524 | 3.71 |

| Quincy Mutual | 21,728 | 3.43 |

| Travelers | 20,300 | 3.2 |

Which auto insurance companies have the most customer complaints?

A“complaint index” records the percentage of complaints versus a company’s market share. What’s important to know here is that the lower numbers zero being the best mean low levels of complaints. Amica and Quincy have Maine’s best auto insurance complaint index, while Amtrust and Farmers have the highest. If you’re debating between insurers, go with the one with the lower complaint index for a better chance of being satisfied with the service.

| # of Complaints | Complaint Index | |

|---|---|---|

| Amica Mutual | 0 | 0 |

| Quincy Mutual | 0 | 0 |

| Dairyland | 1 | 0.5 |

| MMG Insurance Company | 2 | 0.6 |

| Travelers | 2 | 0.6 |

| Allstate Insurance | 6 | 0.7 |

| Concod | 4 | 0.7 |

| Metropolitan | 3 | 0.7 |

| Farankenmuth Insurance | 2 | 0.9 |

| Progressive | 13 | 0.9 |

| The Hanover Insurance | 3 | 0.9 |

| USAA | 4 | 0.9 |

| Liberty Mutual | 10 | 1 |

| State Farm | 16 | 1.1 |

| Hartford Fire & Casualty | 2 | 1.2 |

| Horace Mann | 2 | 1.2 |

| Auto Club Enterprises Insurance | 4 | 1.4 |

| Geico Insurance | 13 | 1.4 |

| Vermont | 2 | 1.4 |

| Amtust NGH | 5 | 2.3 |

| Farmers Insurance | 5 | 3.4 |

Read more: Dairyland Auto Insurance

What do we recommend?

We don’t want to leave you out in the cold, but we’re not here to tell you what to do. Instead, we hope you’ll make up your own mind using all of the research we’ve calculated and compiled for you to find an auto provider that’s great across the board. Don’t settle on the cheapest option without considering factors like customer service and financial stability.

In Maine, Allstate comes in the top 10 for all categories, making it a smart and affordable car insurance choice for most drivers. If you need a nudge in the right direction or some questions to ask, there are licensed agents who would be more than happy to help you New Englanders find what you need. Give them a call today to get started.

Where We Found The Facts

Everything you’ve read here is true except the premiums. We’re not saying they’re fake, but we based them off of certain driver profiles of people who have a 2013 Honda Civic LX (4-door), good credit, and no accidents on their record. If this isn’t you to a tee, your premium will probably be different than what you saw here. We don’t want to mislead you quite the contrary, actually. We just wanted to give you an idea of what people like you pay for insurance so you know what to ask about when you call for auto insurance quotes.

Source Links: