We’ve tracked down a ton of information about how much car insurance coverage costs in Missouri by company and driver type so you can find everything you need in one place. If you root for Mizzou, live anywhere from Kansas City to St. Louis, and know what cherry mash is, this is the car insurance page for you.

The minimum coverage you need to drive legally in Missouri includes bodily injury liability, property damage liability, and uninsured/underinsured motorist coverage. However, these are just the minimum requirements. You may also want to consider adding collision coverage and comprehensive coverage to your auto insurance policy so that you are covered for all possible scenarios.

What Are You Looking For?

- Missouri’s Cheapest Companies

- How Much Drivers Like You Spend On Auto Insurance

- Specific City Rates

- Most Popular Missouri Car Insurance Providers

- Customer Satisfaction Ratings

- Our Recommendation

What are Missouri’s cheapest insurance providers?

There are 205 car insurance companies in Missouri. We looked in-depth at nine of those companies to find average premiums by insurance provider. According to our data, Allied came in as the cheapest. Take a look.

| Missouri's Cheapest Companies | Average Annual Rate |

|---|---|

| Allied | $1,082.55 |

| Allstate | $1,129.55 |

| American Family | $1,163.35 |

| Travelers | $1,321.09 |

| Farmers | $1,402.60 |

| Progressive | $1,572.56 |

| Missouri Farm Bureau | $1,637.85 |

| Geico | $1,762.82 |

| Safeco | $2,194.59 |

*We calculated rates by looking at 10 cities and eight driver profiles of people with 50/100/100 minimum coverage limits, a 2013 Honda Civic LX (4-door), good credit, and no accidents.

How much do drivers like you spend on auto insurance?

Don’t fall into the “average” category? We took our average rates a step further and broke them up by driver type to get a closer estimate to what you might pay for car insurance in Missouri.

Cheapest For Teens

Teen boys will pay about 28% more than their female peers for car insurance. We were able to find the cheapest options for your age group through some number crunching.

Cheapest For Young Adults

Rates drop about 75% from when you’re 18 to when you turn 25. Based on our findings, Farmers comes in super cheap for young adults, but Safeco is still cheaper than the cheapest coverage for 18-year old teen drivers.

| Cheapest for Young Adults | Average Annual Rates |

|---|---|

| Farmers | $642.60 |

| Allied | $678.80 |

| American Family | $734.20 |

| Travelers | $735.80 |

| AUTOMOBILE CLUB OF MISSOURI | $753.00 |

| Allstate | $785.40 |

| Progressive | $934.20 |

| Missouri Farm Bureau | $1,184.40 |

| Geico | $1,285.20 |

| Safeco | $1,678.80 |

Cheapest For Drivers Over 40

We ran the numbers for married drivers who were 40 and 60-years old and found the cheapest rates at about $440 and most expensive around $1,200. Check it out.

| Most Affordable for Drivers Over 40 | Average Annual Rates |

|---|---|

| Farmers | $441.30 |

| Allied | $521.30 |

| AUTOMOBILE CLUB OF MISSOURI | $648.70 |

| American Family | $656.20 |

| Progressive | $741.00 |

| Travelers | $754.60 |

| Allstate | $774.70 |

| Missouri Farm Bureau | $1,018.80 |

| Geico | $1,207.40 |

| Safeco | $1,276.00 |

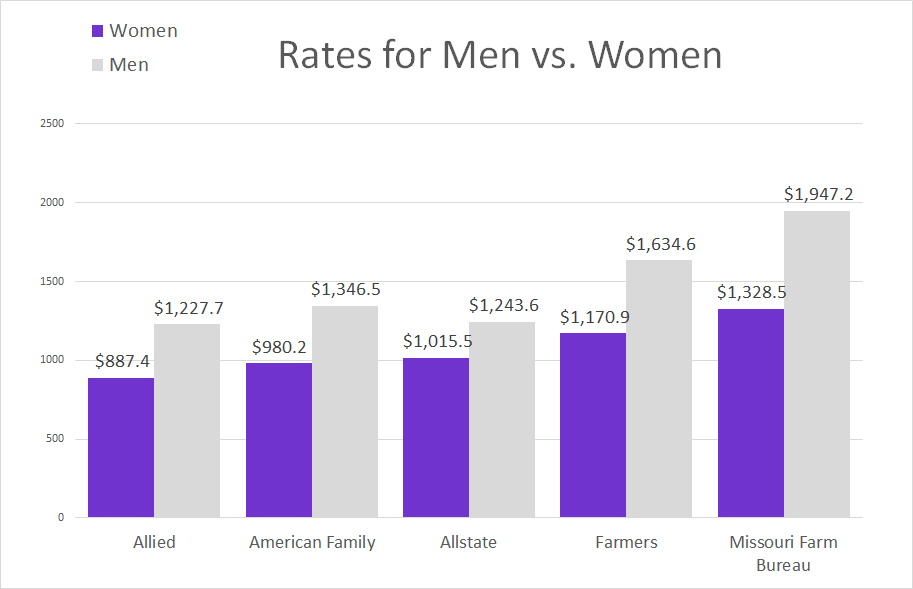

Rates For Men Vs Women

Our experts analyzed the profiles of drivers who were 25 and single and 40 and 60-years old and single to come up with these comparison averages. As you can see, women pay a lot less on average in Missouri, but here is where you can find the cheapest coverage.

In addition to age and gender, auto insurance companies consider factors like your marital status, credit score, and driving record when assigning your rate. If you’re having trouble finding affordable car insurance because of a poor credit history or driving record, make sure to ask about insurance discounts when you’re comparison shopping for auto insurance quotes. Insurance for drivers in the military is usually offered at a discounted rate, and you might also find a good student discount to bring down teen car insurance rates. Many companies also give you a deal for bundling your auto policy with another policy, like homeowners or life insurance. These discounts can bring down your insurance costs considerably.

What are average rates in Missouri cities?

From St. Charles to St. Louis, you’ll find different car insurance premiums. We calculated the averages per city so you can know what to expect for auto coverage.

| Costs by City | Average Annual Rate |

|---|---|

| St. Charles | $1,272.27 |

| Columbia | $1,296.21 |

| Lee's Summit | $1,321.84 |

| O'Fallon | $1,333.38 |

| St. Joseph | $1,368.36 |

| Springfield | $1,370.56 |

| Blue Springs | $1,374.47 |

| Independence | $1,478.87 |

| Kansas City | $1,563.78 |

| St. Louis | $1,708.67 |

County Comparison

Based on counties, this is how rates differ from the four cheapest Missouri carriers across county lines.

| Allstate | Geico | Progressive | Safeco | |

|---|---|---|---|---|

| Johnson County | $1,265.75 | $1,233.25 | $2,178.79 | $1,872.58 |

| Wyandotte County | $1,756.25 | $1,233.25 | $2,423.17 | $2,498.25 |

| Kansas City | $1,300.00 | $2,171.00 | $2,136.00 | $1,511.33 |

What are the most popular Missouri car insurance companies?

Allstate is the second cheapest auto provider in Missouri, so why is it the ninth most popular? That’s what this section is all about. Market share, or what you can look at as a company’s popularity, tells us the percentage of customers a company has compared to competitors. While State Farm has about one quarter of all insured Missouri drivers on their policies, Allstate only have a measly 4% of the population.

But why could this be? This is the question to ask here. When you’re looking for a car insurance company, you don’t just want to go for the cheapest option. You want to pick the company that has the best of everything. It could be that people are paying more for State Farm, American Family, and Progressive because they offer something worthwhile like customer service or coverage options.

Take a look at the market share when you’re searching for auto coverage so you can find clues to things you might not otherwise be aware of.

| Market Share Percent | |

|---|---|

| State Farm | 24 |

| American Family | 13.64 |

| Progressive | 7.77 |

| Liberty Mutual | 6.29 |

| Geico | 6.24 |

| Farmers | 5.92 |

| Shelter Insurance | 5.43 |

| Auto Club Enterprises | 4.87 |

| Allstate | 4.17 |

| Nationwide | 3.65 |

What companies have the best customer satisfaction ratings?

A “complaint index” shows the percentage of customers who complain compared to a company’s market share.

A company like Aegis or Hanover are examples of great scores because their complaint indexes are zero. Based on our research, State Farm has an abysmal score in Missouri of 23. That means that less people are complaining at Aegis and Hanover and a lot more have something bad to say about State Farm.

Make sure to look this table over to see if the car insurance provider you’re interested in has a low complaint index. It means you might be happier with its service since more of its policyholders are content.

| Premiums Written | Complaints | Complaint Ratio Per 1 Million in Premiums | |

|---|---|---|---|

| AIG | $1,391,119 | 0 | 0 |

| Ace | $1,721,003 | 0 | 0 |

| Assurant | $1,760,491 | 0 | 0 |

| Markel Grp | $2,805,544 | 0 | 0 |

| Guideone Ins | $2,997,252 | 0 | 0 |

| Standard Fire | $7,397,777 | 1 | 0.14 |

| United Fire & Casualty | $5,588,617 | 1 | 0.18 |

| Allianz | $4,286,412 | 1 | 0.23 |

| Cincinnati Ins. Co | $5,942,567 | 2 | 0.34 |

| State Farm | $721,378,692 | 258 | 0.36 |

| Acuity | $5,589,768 | 2 | 0.36 |

| Shelter Ins | $169,289,527 | 66 | 0.39 |

| Nationwide | $106,207,407 | 49 | 0.46 |

| Electric Ins | $10,682,721 | 5 | 0.47 |

| USAA | $101,161,099 | 55 | 0.54 |

| Grinnell Mutual | $8,713,377 | 5 | 0.57 |

| Travelers | $38,057,234 | 22 | 0.58 |

| The Hartford | $50,703,294 | 30 | 0.59 |

| Chubb | $3,347,858 | 2 | 0.60 |

| American Family | $428,136,933 | 259 | 0.60 |

| Auto Owners Grp | $17,503,458 | 11 | 0.63 |

| California Casualty | $3,165,222 | 2 | 0.63 |

| Allstate | $97,000,514 | 62 | 0.64 |

| American National | $15,204,961 | 10 | 0.66 |

| Country Ins | $13,224,827 | 9 | 0.68 |

| Metlife | $9,991,077 | 7 | 0.70 |

| Columbia Ins | $11,164,693 | 8 | 0.72 |

| Horace Mann | $4,051,476 | 3 | 0.74 |

| Farmers | $181,204,042 | 136 | 0.75 |

| Safeco | $130,051,091 | 99 | 0.76 |

| Missouri Farm Bureau | $65,175,896 | 51 | 0.78 |

| Auto Club Enterprises | $153,793,682 | 122 | 0.79 |

| Amica Mutual | $3,655,722 | 3 | 0.82 |

| Liberty Mutual | $49,683,212 | 41 | 0.83 |

| Cornerstone National | $15,026,448 | 13 | 0.87 |

| Progressive | $236,267,646 | 205 | 0.87 |

| 21st Century | $15,048,870 | 15 | 1.00 |

| Country Ins | $18,924,474 | 19 | 1.00 |

| Geico | $182,691,590 | 191 | 1.05 |

| State Auto Mutual | $13,374,813 | 14 | 1.05 |

| IDS | $4,774,431 | 5 | 1.05 |

| Esurance | $20,876,150 | 24 | 1.15 |

| Cameron Mutual | $18,799,916 | 25 | 1.33 |

| Secura Ins | $1,858,223 | 3 | 1.61 |

| Dairyland | $19,197,031 | 31 | 1.61 |

| 1st Auto & Casualty | $2,978,294 | 5 | 1.68 |

| Motorists Mut | $2,569,369 | 5 | 1.95 |

| National General | $6,849,848 | 15 | 2.19 |

| EMC | $1,319,066 | 3 | 2.27 |

| Safe Auto | $15,228,233 | 45 | 2.96 |

| Traders Ins Co | $9,591,409 | 33 | 3.44 |

| Insuremax | $1,707,646 | 6 | 3.51 |

| Kemper Corp Grp | $5,229,958 | 19 | 3.63 |

| AssuranceAmerica | $2,377,718 | 9 | 3.79 |

| Home State Ins | $2,893,773 | 11 | 3.80 |

| Loya Grp | $5,249,680 | 21 | 4.00 |

| Benchmark | $1,234,942 | 5 | 4.05 |

| American Independent | $1,552,313 | 7 | 4.51 |

| Alfa Ins | $11,547,166 | 53 | 4.59 |

| Direct General | $4,617,071 | 25 | 5.41 |

| First Acceptance | $4,171,707 | 30 | 7.19 |

| Affirmative Ins | $2,989,528 | 22 | 7.36 |

What do we recommend?

All of the information on this page is designed to help you make the best decision for yourself. If you do need a little help, we’ll tell you that picking a car insurance company that has good scores or rankings across multiple categories is always a smart choice. Don’t limit your choices to only the cheapest car insurance companies or the largest car insurance companies. For Missouri, American Family is a great choice all around because it has a zero for customer complaints (which is the best it can be), the second highest market share in the state, and the third cheapest rates. Allstate is also up there.

You can either go off of that or give licensed insurance agents a call so they can help you shop around for quotes or answer any questions you might have. They are the experts, after all.

Where We Found The Facts

We spend hours tracking this data down, analyzing it, and turning it into information you can actually understand and want to read! The only thing that might not ring true for you is the premium averages. We used customer profiles of people with 50/100/100 minimums, a 2013 Honda Civic LX (4-door), good credit, and no accidents. If your driver profiles doesn’t match this perfectly, you can expect a different rate. We just want to give you an idea of what people like you pay for insurance in Missouri so you have something to go on when you shop for car insurance quotes.

Source Links:

- Ratekick.com