We’ve done the research to find everything you need to know from average premiums by insurance company to the most popular ones. If you drink “caw-fee,” harbor a healthy Red Sox rivalry, and have some of the best pizza around, this car insurance page is most certainly for you New York drivers.

What Are You Looking For?

- New York’s Cheapest Companies

- How Much Drivers Like You Spend On Auto Insurance

- Specific City Rates

- Most Popular New York Car Insurance Providers

- Our Recommendation

Where Can You Find New York’s Cheapest Auto Policies?

There are 172 insurance companies in New York. We decided to take an in-depth look at seven companies and calculate average annual car insurance premiums based on 10 cities and eight driver profiles. See how much car insurance company rates fluctuate by checking out the cheapest options below.

| New York's Cheapest Car Insurance | Average Annual Rates |

|---|---|

| New York Central Mutual | $1,004.97 |

| Geico | $1,230.95 |

| Allstate | $1,304.00 |

| Travelers | $1,359.13 |

| Chubb | $1,609.20 |

| Nationwide | $2,085.14 |

| Liberty Mutual | $2,138.97 |

*These premiums were calculated by using driver profiles of people with a 2013 Honda Civic LX (4-door), good credit, no accidents, and 50/100/110 coverage.

Of course, these results can vary widely based on a bunch of little things including credit score, driving record, and which discounts you take advantage of. A clean driving record is just one part of insurance pricing. When it comes to cheap car insurance, getting your own quotes is crucial.

How Much Drivers Like You Spend On Auto Insurance

Every driver is unique. Check out our more specific rates for different driver profiles below so you can find rates that might more closely match your own life.

Cheapest For Drivers 25 And Under

Based on the 18 and 25-year old driver profiles we ran number for, we were able to find the cheapest car insurance companies in New York for this age group. Take a look.

| New York's Cheapest Car Insurance | Average Annual Rates |

|---|---|

| New York Central Mutual | $1,110.00 |

| Geico | $1,479.70 |

| Allstate | $1,677.85 |

| Travelers | $1,997.20 |

| Chubb | $2,092.40 |

| Nationwide | $2,876.06 |

| Liberty Mutual | $2,958.50 |

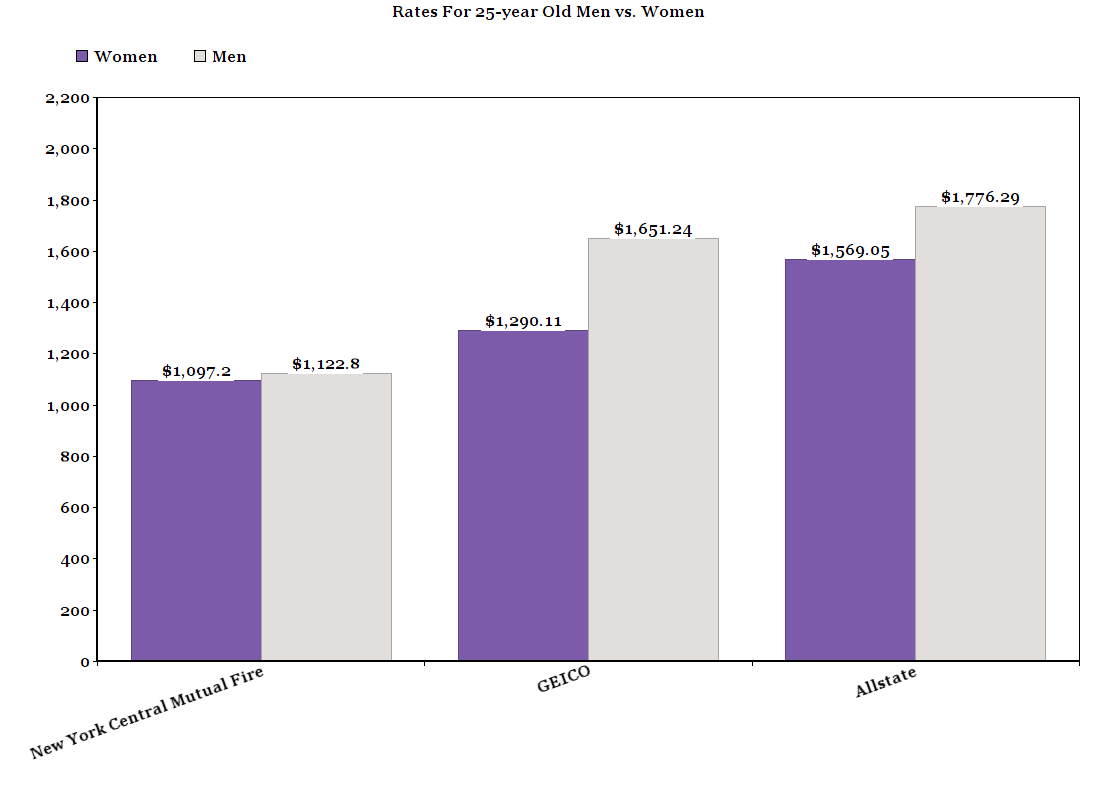

Rates For 25-Year Old Men Vs Women

Men pay about 10% more than women for car insurance. Chubb is the only exception—women will pay 2% more with them. But as you can see, here’s how our cheapest auto insurance calculations break down for young male and female drivers.

Cheapest For Gen X Drivers

Based on profiles of married men and women who are 40-years old, our data pointed out that the cheapest auto insurance companies for your age group as are follows:

| Average Annual Rates | |

|---|---|

| Travelers | $742.80 |

| Allstate | $941.30 |

| Geico | $970.70 |

| New York Central Mutual | $987.20 |

| Chubb | $1,195.70 |

| Liberty Mutual | $1,400.10 |

| Nationwide | $1,500.80 |

How Does Your City Affect Average Rates?

From Binghamton to the Big Apple, you’ll find different car insurance rates. Auto insurance companies use thousands and millions of data points to calculate risk and that’s why it varies so much. Crime rates, traffic patterns, and the likelihood of different kinds of claims all play into your rates. Even if you have a clean driving record, you’re still a higher risk if you live in an area that has a lot of accidents, break-ins, etc. Binghamton is the cheapest for auto coverage, but take a look to see how your city measures up based on our data.

| City | Average Annual Rates |

|---|---|

| Binghamton | $1,113.41 |

| West Seneca | $1,232.58 |

| Schenectady | $1,240.96 |

| Albany | $1,253.70 |

| Long Beach | $1,282.72 |

| Irondquoit | $1,296.37 |

| Niagra Falls | $1,365.70 |

| New Rochelle | $1,389.41 |

| Ceektowaga | $1,423.70 |

| Tonawanda | $1,426.15 |

| Troy | $1,426.15 |

| Utica | $1,464.22 |

| Rochester | $1,481.78 |

| Syracuse | $1,502.37 |

| White Plains | $1,710.85 |

| Buffalo | $1,718.44 |

| Yonkers | $2,021.26 |

| West Seneca | $2,044.00 |

| Mount Vernon | $2,098.72 |

| New York City | $2,133.60 |

| Hempstead | $2,311.54 |

Who Is The Most Popular New York Car Insurance Provider?

Market share is something that shows how many customers a company has compared to competitors. Based on our analysis, Geico is New York’s most popular auto insurance provider with nearly one third of all insured drivers on their policies. Looking at this kind of data can show you where the most customers are going and give you an idea how well liked certain companies are.

The most popular company isn’t always the cheapest car insurance company. Insurance companies have to cater to a range of preferences to get the highest market share. Insurance cost is a small part of the bigger picture.

| New York's Cheapest Car Insurance | Average Annual Rates |

|---|---|

| New York Central Mutual | $1,004.97 |

| Geico | $1,230.95 |

| Allstate | $1,304.00 |

| Travelers | $1,359.13 |

| Chubb | $1,609.20 |

| Nationwide | $2,085.14 |

| Liberty Mutual | $2,138.97 |

Read more:

- Chubb Group Auto Insurance Review

- Top auto insurance Companies Operating Today

What Is Our Recommendation?

We want you to use our data and analysis to make the best car insurance decision for you. Just keep in mind that you should always choose a carrier that ranks well across multiple categories. According to our research, Geico ranked number one for New York auto insurance market share and second for cheapest rates. Going with a company like that that has great scoring overall will help you find better coverage.

If you’re not sure what to do, give a licensed agent a call. They’re very experienced in New York auto coverage and insurance as a whole.

Where We Found The Facts

All of the premiums above were calculated using driver profiles of people who have a 2013 Honda Civic LX (4-door), good credit, no accidents, and 50/100/110 coverage. While those numbers are real, they might not be what you’ll pay as a policyholder if your personal details are any different. We just wanted to be able to show you what average drivers pay so you have a better understanding of the prices out there.

Source Links:

- Ratekick.com