Drive Safely or Pay—How Much Your Speeding Can Increase Your Rates

work incident injuri form

work incident injuri form

There’s an endless variety of motorists on the road: reckless teenagers, lead-footers, distracted texters, and so on. But not you. You’re a good driver—you’re cautious, respectful, and patient. But you might also have a speeding ticket or two. Maybe you ran a red light last year and found yourself pulled to the side of the road by a friendly state trooper. So, how do these blemishes affect your insurance rates?

We analyzed the data and broke down the numbers by gender, age, and infraction severity to give you an idea as to how these factors impact your ability to find affordable insurance. We’ve also thrown in a few tips to help you save money after a ticket or accident.

I Just Got a Speeding Ticket—Will My Car Insurance Rates Go Up?

Speeding tickets and at-fault accidents both affect car insurance rates, leading to higher premiums and increased costs.

For our sample, we took data from the California Department of Insurance, broke it down by age, driving history, marital status, and more. Then we compared average rates from 20 major insurance companies in California.

It’s true that average rates can vary widely by state. But for our purposes, we wanted to show the degree to which tickets and accidents affect rates, which is why we’ve focused on percentage increases as compared to clean driving records.

The breakdown of our sample data by different scenarios is below.

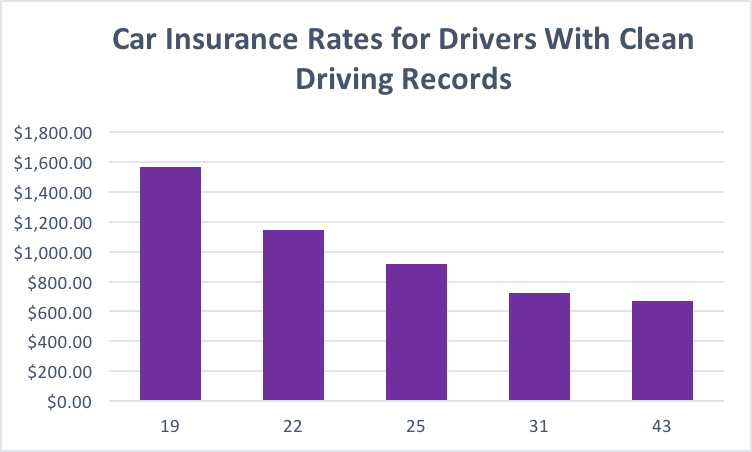

Drivers with Clean Histories

Drivers with a clean driving record is our baseline. The average California driver with a clean record paid $932 per year, or about $78 per month. Note that male drivers pay more on average by about $40, and drivers in their late teens pay about twice as much as those in the mid 40’s.

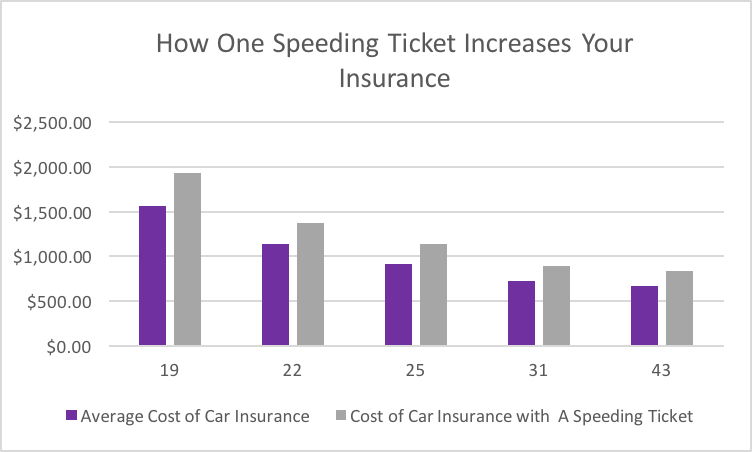

One Speeding Ticket

Having just one speeding ticket on your record can really do a number on your insurance rates. We found a 23 percent average increase, which equates to an additional $218 per year. Young drivers at 19 years old experienced the greatest increase, paying an extra $367 (or $35 a month) for having just one ticket.

Female drivers experienced a larger increase in their insurance premiums from one speeding ticket. This is true whether you were going 5 or 50 over. The average increase for women was 25 percent whereas males had an increase of 22 percent. Of course, men also start at a higher rate.

Read more:

- The True Cost Of A Speeding Ticket: Everything You Need To Know

- The Impact Of Speeding Tickets On Your Oklahoma Insurance: What You Need To Know

- The Impact Of Speeding Tickets On Your Michigan Insurance Rates

- The Impact Of Speeding Tickets On Your Insurance Rates In Wisconsin

- The Impact Of Speeding Tickets On Your Insurance Rates In Massachusetts

- The Impact Of Speeding Tickets On Your Insurance Rates In Maine

- The Impact Of Speeding Tickets On Your Connecticut Auto Insurance Rates

- The Impact Of Speeding Tickets On Your Auto Insurance Rates In Kansas

- The Impact Of Speeding Tickets On Your Arkansas Insurance Rates

- The Impact Of Speeding Tickets On Auto Insurance Rates In West Virginia

- The Impact Of Speeding Tickets On Auto Insurance Rates In South Dakota

- The Impact Of Speeding Tickets On Auto Insurance Rates In Arizona

- The Impact Of A Speeding Ticket On Your Oregon Insurance Rates

- The Impact Of A Speeding Ticket On Your Ohio Insurance Rates

- The Impact Of A Speeding Ticket On Your North Carolina Insurance Rates

- Understanding The Impact Of Speeding Tickets On Your Maryland Insurance Rates

- Understanding The Impact Of Speeding Tickets On Your Insurance Rates In New Jersey

- Understanding The Impact Of Speeding Tickets On Your Texas Insurance Rates

- Understanding The Insurance Consequences Of A Speeding Ticket In Tennessee

- Understanding The Insurance Consequences Of A Speeding Ticket In Washington, D.C.

- Understanding The Insurance Implications Of A Speeding Ticket In Florida

- Understanding The Insurance Implications Of A Speeding Ticket In Illinois

- Understanding The Insurance Implications Of A Speeding Ticket In Pennsylvania

- Understanding The Insurance Implications Of A Speeding Ticket In Rhode Island

- Understanding The Impact Of A Speeding Ticket On Your Georgia Insurance Coverage

Enter your zip code below to view companies that have cheap insurance rates.

Secured with SHA-256 Encryption

What Effect Does One At-Fault Accident Have on Your Rates?

One at-fault accident can increase your car insurance rates even more than multiple speeding tickets. We looked at how one accident affected drivers by age and by gender. On average, rates increased by 28 percent, but older drivers experienced some of the highest jumps. A 43-year-old driver could pay an additional $259 per year, or a 35 percent increase.

Males and females experienced similar average rate increases, with males at 28 percent and females at 27 percent. Either way, you know that filing even just one crash claim will result in paying more money for car insurance.

Keep in mind, auto insurance policies do factor in how much they paid out, if it was your fault, etc. Even if they only paid $1,000, your annual premium could go up for years to come. So always consider whether getting payment now is worth a higher premium later.

Read more: Why Does Insurance Go Up After An Accident?

What Effect Do Two Speeding Tickets Have on Your Rates?

Maybe you haven’t caused any accidents, but you’ve gotten a couple of speeding tickets. Although not as high as the accident-related increases, we found that two speeding tickets resulted in an average 28 percent rate jump. Speed demons beware: Your driving habits could end up costing you.

Notably, senior drivers ended up paying more for double speeding tickets than those in their twenties. Rates for drivers 65 to 67 went up by 31 percent while people 27 to 29 saw only 25 percent jumps.

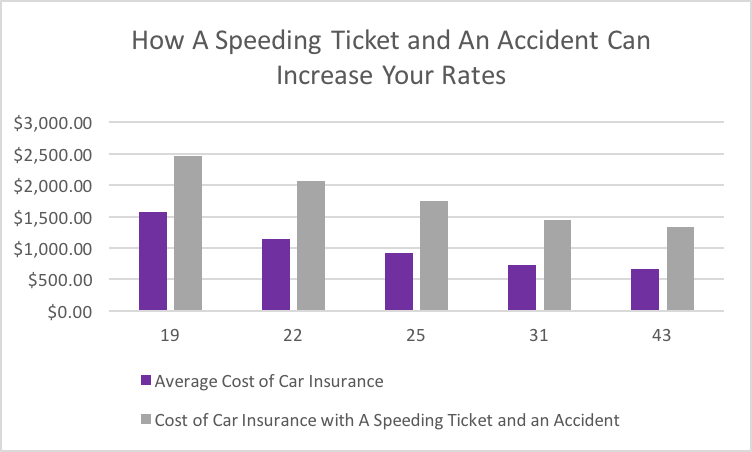

What Effect Does One Speeding Ticket and One At-Fault Accident Have on Your Rates?

Here’s where the rate hikes start getting scary. Having both a speeding ticket and one at-fault accident on a driver’s record led to average rate increases of 86 percent. That equates to $798 more per year, or more than $66 a month. This could definitely put a dent in your budget.

The rate jumps increased with age, with younger drivers seeing the smallest increase of 57 percent and 31 to 41-year-olds experiencing 99 percent they’re paying nearly double the rates of people their age with clean records!

We also saw slightly higher increases for women over men. Females’ rates went up by 89 percent. Males got 83 percent.

Read more: Does Car Insurance Go Up with a Ticket?

Enter your zip code below to view companies that have cheap insurance rates.

Secured with SHA-256 Encryption

When Will Your Auto Insurance Rates Increase after An Incident?

Car insurance rate jumps don’t happen immediately, and insurance companies don’t care if it was just a few miles per hour over. Your car insurance company adjusts your rates after it has had time to process your claims, review your driving record, and analyze your potential risk for future infractions. You’ll likely see any potential rate increases on your bill when your policy renews (usually once every six months or one year) if they check.

Keep in mind, this only happens if you switch insurers or your current insurer checks your record. It costs them money every time they do it. So many companies will only check if you give them a reason to. This could include not paying your premium on time, getting in an accident, submitting a request from the state for proof of insurance after a DUI, etc.

How Long Will Rate Increases Last?

Costs due to speeding tickets and car accidents can follow you for a long time. If you’re a high-risk driver who requires additional paperwork, it could last until that requirement expires. But every insurance company handles the issue differently.

In general, some may require you to pay the higher premiums for three years. Others will hike your rate for a year and then give you a break after one year of a clean record.

This is one reason why it’s important to shop around for car insurance. Each company treats driving histories differently, and one may offer an extra driver discount, you may find a cheaper option by switching.

In particular, if you’ve seen particular improvements in your credit score or driving record, you should see a comparable improvement in your auto insurance premiums. It may take a bit longer than you’d like, but if auto insurance premiums don’t drop to what they were at some point, you could be paying too much.

We all run into traffic violations occasionally. Even a safe driver makes mistakes or runs into bad luck. You can take extra steps to lower your rate like attending a defensive driving class.

Any insurance rate increase won’t last forever, especially if you drive carefully and avoid more tickets.

Tips to Save after a Ticket or At-Fault Accident

So, let’s say you’ve just had an accident and you’re worried about that impending rate hike we discussed above. Here are a few things you can do to save as much money as possible:

- Drive differently. You can expect one ticket or accident to lead to a premium hike. But additional dings on your record could be even costlier. Lay off the gas pedal and be extra careful on the roads to avoid any more car insurance drama. Plus, many companies will lower your rates after a certain period of safe driving.

- Change your coverage. If you’ve been paying for premium coverage—such as low deductibles, comprehensive packages, or towing packages—consider dropping these add-ons. Although you’ll be at higher risk for paying for a future accident, increasing your deductibles and eliminating extra coverage should save you in the short term.

- Use those discounts. If you didn’t when you signed up, ask your agent or insurance company if you’re eligible for any discounts. Most policies include some opportunities to save, and there may be new ones for you to take advantage of.

- Switch companies. While it won’t guarantee lower rates, shopping around for new car insurance could lead to lower rates. Although your driving record will still be reviewed (be honest!), some companies don’t penalize their customers as strongly as others.

In our review of auto insurance companies, we learned that The General Automobile Insurance Services may be a good option for high-risk drivers (those who have less-than-perfect driving histories). If it’s available in your area, you might get lower rates with The General, even if you have multiple speeding tickets or accidents.

Or, learn more about average rate costs among various insurance companies in your own state, by selecting where you live below.

Bottom Line

Speeding tickets and at-fault accidents are a surefire way to increase your auto insurance rates, but you don’t need to panic If you’ve already experienced a ticket or accident, you can take steps to mitigate the damage to your wallet. And as always, it’s a good idea to shop around for multiple car insurance quotes whenever you’re on the hunt.

Fortunately for you, we can help you with the process. Obrella has independent agents that can give you a quote over the phone, or tell us a bit about yourself and we’ll send you an email. Call us at [mapi-phone /] —we’ve got your back.

Free Insurance Comparison

Enter your zip code below to view companies that have cheap insurance rates.

Secured with SHA-256 Encryption