Our job is to make your life easier by doing all of the necessary auto insurance research to bring you the facts. If you spend time at the honky tonks, love country music, and root for the Titans, this auto insurance page is for you.

What Are You Looking For?

- Tennessee’s Cheapest Companies

- How Much Drivers Like You Spend On Auto Insurance

- Specific City Rates

- Most Popular Tennessee Car Insurance Companies

- Customer Satisfaction Ratings

- Our Recommendation

We’ve compared different auto insurance companies in Tennessee for people of different ages and those looking for different coverage types. Some people prefer to drive with only the state minimums while others want more comprehensive auto insurance. Most people want the extra coverage, but they’re on a budget. So they’re more likely to take cheap car insurance, even when it doesn’t actually meet their needs.

There’s good news about car insurance in Tennessee. An annual rate within your budget that covers what you really need may be closer than you think.

Who Are Tennessee’s Cheapest Auto Insurance Companies?

We wanted to be able to give you accurate car insurance premiums by company in Tennessee. So we took data from eight driver profiles and four cities to come up with average annual auto coverage rates for eight companies. We also had all of our sample drivers drive a 2013 Honda Civic LX (4-door), have good credit, 50/100/110 coverage, and no accidents on record. If this sounds like you, check out what you could be paying for car insurance in Tennessee based on our research.

| Cheapest Companies in Tennessee | Average Yearly Rates |

|---|---|

| Farmers Mutual of Tennessee | $1,023.97 |

| Farmers | $1,131.73 |

| Allstate | $1,325.77 |

| Progressive | $1,529.80 |

| Travelers | $1,730.20 |

| Geico | $2,098.23 |

| Safeco | $2,174.50 |

| Liberty Mutual | $4,057.84 |

How Much Do Drivers Like You Spend on Auto Insurance?

Auto insurance companies use millions of data points to calculate premiums. We took it a step further and ran numbers for different types of drivers to find more accurate rates. Take a look.

Cheapest For Millennials

We took information from 18-25-year old drivers to come up with the cheapest car insurance companies for your age group. You’ll find that your rates will change quite a bit from 18 to 25 and that they’ll even go up and down depending on if you’re male or female. Take a look.

| Average Yearly Rates | |

|---|---|

| Tennessee Farmers | $1,444.28 |

| Farmers | $1,522.69 |

| Allstate | $1,870.27 |

| Progressive | $2,530.00 |

| Travelers | $2,787.93 |

| Geico | $3,012.87 |

| Safeco | $3,347.87 |

| Liberty Mutual | $5,608.86 |

Read more: Finding The Best Auto Insurance For 25-Year-Olds

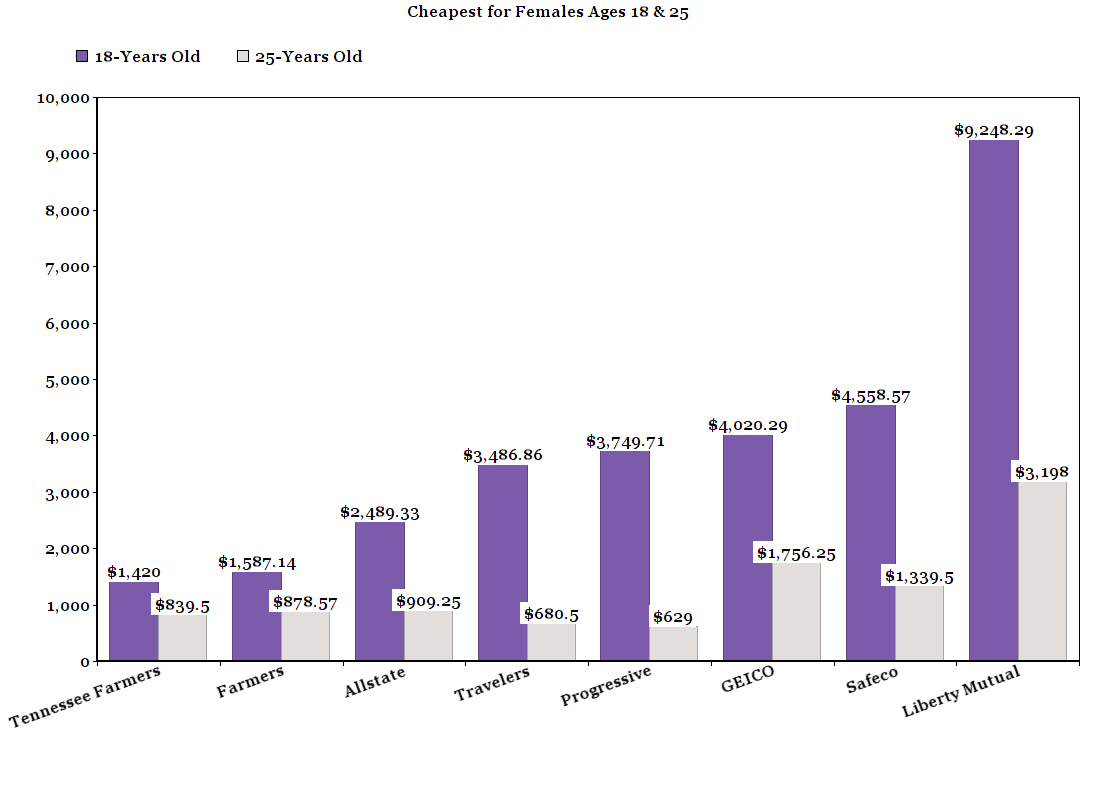

Cheapest For Female Millennials

Women will pay about 22% less for car insurance in Tennessee than their male peers. The biggest difference is for 18-year olds, but by the time you turn 25, the premium averages are more equal between both genders.

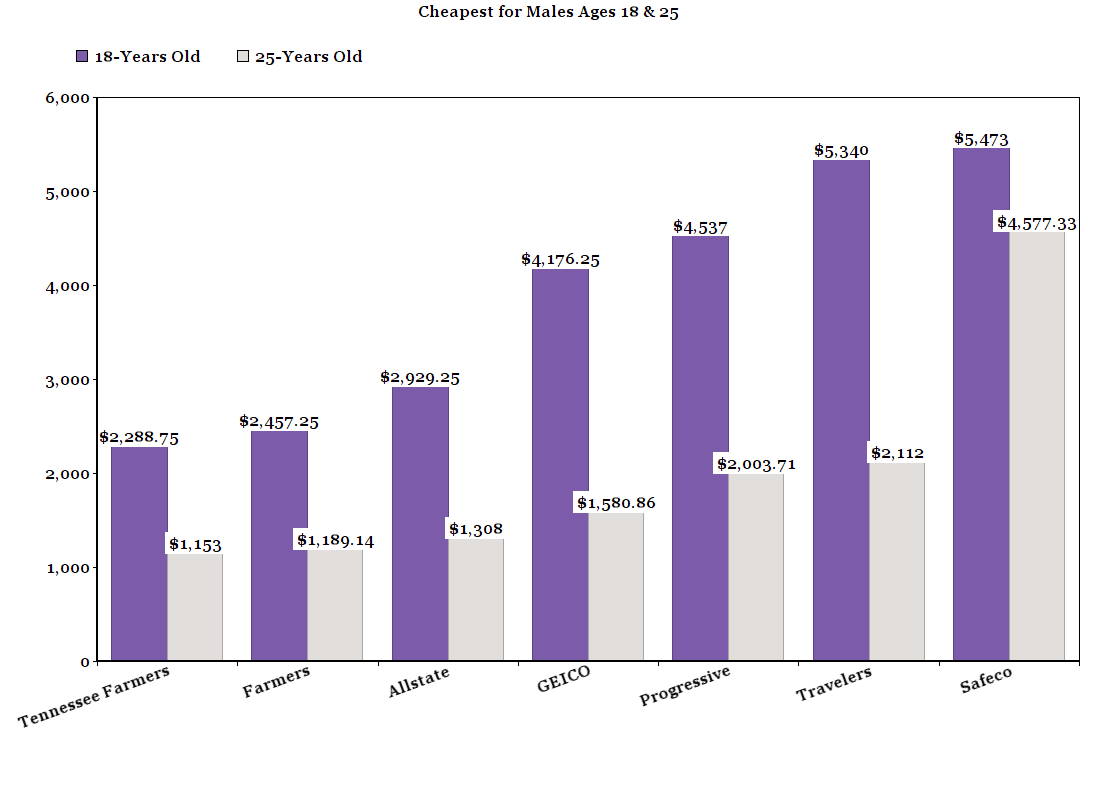

Cheapest For Male Millennials

Our research shows that the average cost for 18-year old male millennials is almost 22% more for car insurance the their female peers. However, by the time you turn 25, you’ll be paying closer to what your female millennial friends pay. Take a look.

Cheapest For Married Couples

After doing the math for 40 and 60-year old married couples, we were able to calculate the cheapest annual premium by car insurance provider for you. Progressive is by far the cheapest with rates nearly $1,500 cheaper than the most expensive, Geico.

| Average Yearly Rate | |

|---|---|

| Progressive | $529.60 |

| Tennessee Farmers | $630.77 |

| Travelers | $672.47 |

| Farmers | $753.80 |

| Allstate | $781.27 |

| Safeco | $1,001.13 |

| Geico | $1,183.60 |

Cheapest For Senior Citizens

As you age, car insurance premiums typically drop. Our research proves this with some of the cheapest car insurance rates in the state of Tennessee below.

| Average Yearly Rate | |

|---|---|

| Progressive | $485.87 |

| Tennessee Farmers | $560.00 |

| Travelers | $642.93 |

| Farmers | $705.47 |

| Allstate | $765.60 |

| Safeco | $909.33 |

| Geico | $1,122.40 |

| Liberty Mutual | $2,832.53 |

How Does Your City Affect Auto Insurance Rates?

From Johnson City to Jackson, you’ll drive past a lot of different car insurance rates. Based on our findings, there’s about a $1,000 difference in annual car insurance premiums between the two cities. Check out the chart to see how much you could be paying in your city for car insurance based on our research.

| Cheapest Cities for Insurance | Average Yearly Rates |

|---|---|

| Johnson City | $1,561.81 |

| Cleveland | $1,625.42 |

| Hendersonville | $1,638.52 |

| Franklin | $1,648.52 |

| Kingsport | $1,703.19 |

| Clarksville | $1,750.90 |

| Smyrna | $1,761.44 |

| Murfreesboro | $1,769.38 |

| Chattanooga | $1,769.75 |

| Knoxville | $1,788.40 |

| Nashville | $1,885.06 |

| Collierville | $1,931.68 |

| Bartlett | $2,138.13 |

| Memphis | $2,169.68 |

| Jackson | $2,517.23 |

One thing to remember: Your insurance rate is affected by how much you drive, which means your commute could be a big factor in how much you pay. Check out our list of the 15 Best and Worst Commuter Cities in Tennessee to see what commuter cities are going to be best for your insurance rate.

Who Are The Most Popular Tennessee Car Insurance Providers?

Market share is the percentage of customers a company has compared to competitors. In Tennessee, State Farm has the most policyholders almost 25% of all insured drivers in the state! When you’re looking to choose an auto insurance provider, make sure you know how many customers they have. The ones with the most might have been able to do so because they offer great pricing, customer service, or coverage options. Of course, the exact combination of factors is often mixed. We know cheap prices don’t always come with great service, and there are people willing to pay as much as they need to for convenience or put up with whatever problems they need to for the right price. In most cases, people fall somewhere in the middle. They choose the auto insurance coverage that has a price they can afford and gives them more of the features and service they want.

| Market Share | |

|---|---|

| State Farm | 23.96 |

| Tennessee Farmers | 17.51 |

| Allstate | 7.21 |

| Geico | 6.93 |

| Progressive | 5.98 |

| Liberty Mutual | 5.47 |

| USAA | 5.33 |

| Nationwide | 4.62 |

| Travelers | 2.24 |

| Farmers | 2.22 |

What Do Customer Satisfaction Ratings Say about Auto Insurance Policies in Tennessee?

A “complaint index” shows the percentage of customers who complain compared to a company’s market share. A zero is the best score in this case because it means little to no customers are complaining. Higher numbers indicate more complaints. During our research, we found that USAA has the best complaint index in Tennessee, and Farmers has the worst. Make sure you take a look so you know how insurance companies are doing at keeping their customers happy.

| Premiums Written | Complaint Index | |

|---|---|---|

| USAA | $443,344,049 | 0.75 |

| State Farm | $296,024,824 | 0.87 |

| Geico | $126,112,530 | 0.96 |

| Tennessee Farmers | $124,212,480 | 0.85 |

| Progressive | $107,897,893 | 0.91 |

| Allstate | $89,624,668 | 1.6 |

| Nationwide | $87,024,869 | 0.61 |

| Liberty Mutual | $82,551,509 | 1.19 |

| Travelers | $46,219,285 | 2.94 |

| Farmers Insurance | $44,609,288 | 2.37 |

Read more: Comparing Auto Insurance Providers: Allstate, Geico, Progressive, And State Farm

What Is Our Recommendation? Get An Insurance Quote Today

All of our research and data is to help you choose the best car insurance policy for yourself. We hope you’ll take all of what you’ve found on the page and compare auto insurance providers based on overall scores.

Tennessee Farmers, for instance, scored fourth for customer service, second for popularity (market share), and came in first for the cheapest overall rates. Progressive was also a stand out because it came in fourth for cheapest policies, fifth for customer service, and fifth for market share.

You can use that recommendation there or give knowledgeable agents a call. They’ll be able to help you with everything from basic questions to shopping around for quotes. While we posted averages, each quote is unique to the driver. The base rates for your demographic may be lower with one carrier. But the right combination of insurance discounts could push another carrier over the edge to give you a lower rate.

Our goal is to help more people get the auto insurance coverage limits they need. This means putting coverage first and then finding a carrier has the best pricing for that plan. Ultimately, the choice is up to you.

Where We Found The Facts

We used very specific data to calculate premiums on this page. If you aren’t someone who drives the car we used—a 2013 Honda Civic LX (4-door)—has good credit, 50/100/110 coverage, and doesn’t have any accidents on your driving record, then your rates will most likely be different. These rates are 100% accurate for those types of policyholders we analyzed, but just know that yours could fluctuate depending on your own information.

Source Links:

- Tennessee Department of Insurance

- Ratekick.com