We’re here to help you find all the auto insurance information you need to know as an insured Wisconsin driver. If you love cheese and the Green Bay Packers, this page is for you.

What Are You Looking For?

- Wisconsin’s Cheapest Companies

- How Much Drivers Like You Spend On Auto Insurance

- Specific City Rates

- Most Popular Wisconsin Car Insurance Companies

- Customer Satisfaction Ratings

- Our Recommendation

What are the minimum requirements for auto insurance in Wisconsin?

Wisconsin’s minimum coverage requirements consist of bodily injury liability coverage and property damage liability coverage.

However, for many drivers, the minimum insurance requirement for liability insurance is not enough. It is recommended you add collision coverage and comprehensive coverage to your auto policy to make sure you’re fully covered, and if you’re still paying off your car, your lender or financial institution may require these coverages.

You have many more additional coverage options to consider as well, including uninsured/underinsured motorist coverage, personal injury protection, GAP insurance, and roadside assistance.

What are Wisconsin’s cheapest car insurance companies?

Curious about where you can find cheap car insurance in Wisconsin? We used the profile of a driver with a 2013 Honda Civic LX (4-door), good credit, 50/100/100 coverage, and no accidents to find the least expensive rates. There are 32 companies that sell auto insurance coverage in Wisconsin, but here’s a look at the 12 most popular that we researched, with rates being the average in 10 cities.

| Average Quote | |

|---|---|

| American Family | $693.40 |

| Progressive | $778.45 |

| The General | $918.80 |

| Farmers | $938.30 |

| Nationwide | $1,179.50 |

| Geico | $1,417.40 |

| Liberty Mutual | $1,424.40 |

| Travelers | $1,434.50 |

| Allstate | $1,479.65 |

| Allied | $1,545.75 |

| Acuity | $3,147.25 |

| AAA | $3,519.25 |

American Family, Progressive, The General, and Farmers come in with rates that are less than $78 a month. All are great choices for cheap car insurance.

In addition to age, gender, and marital status, car insurance companies factor your credit score and driving record into your premium. If you have a bad credit history or you don’t have a clean driving record, make sure to ask about insurance discounts when you’re shopping for auto insurance quotes. Major insurers offer opportunities to save like the good student discount, safe driver discount, and the discount for taking a defensive driving course. You may also get a discount for bundling two types of insurance, like an auto insurance policy and a homeowners insurance policy. Discounts like these can significantly bring down your insurance costs.

You might also want to ask your prospective insurance provider if they have an accident forgiveness program, as this can save you money down the line.

How much do drivers like you spend on auto insurance?

If you’re not an average driver, then your auto insurance quote will most likely differ from the average rates above. That’s why we broke down rates for certain driver types below to give you a closer idea of what you can expect to pay for your insurance premium.

Cheapest For Drivers 21 and Under

Looking at rates of drivers 18-25, we found the cheapest auto insurance companies for this demographic. If you’re a young driver in Wisconsin, here’s where you might be able to find the cheapest rates.

| Average Quote | |

|---|---|

| American Family | $875.60 |

| Progressive | $1,122.80 |

| The General | $1,270.10 |

| Farmers | $1,483.00 |

| Nationwide | $1,727.00 |

| Geico | $1,930.20 |

| Liberty Mutual | $2,007.70 |

| Allstate | $2,022.70 |

| Travelers | $2,316.20 |

| Allied | $2,354.00 |

| AAA | $5,064.10 |

| Acuity | $5,117.70 |

Read more: Nationwide Vs AAA

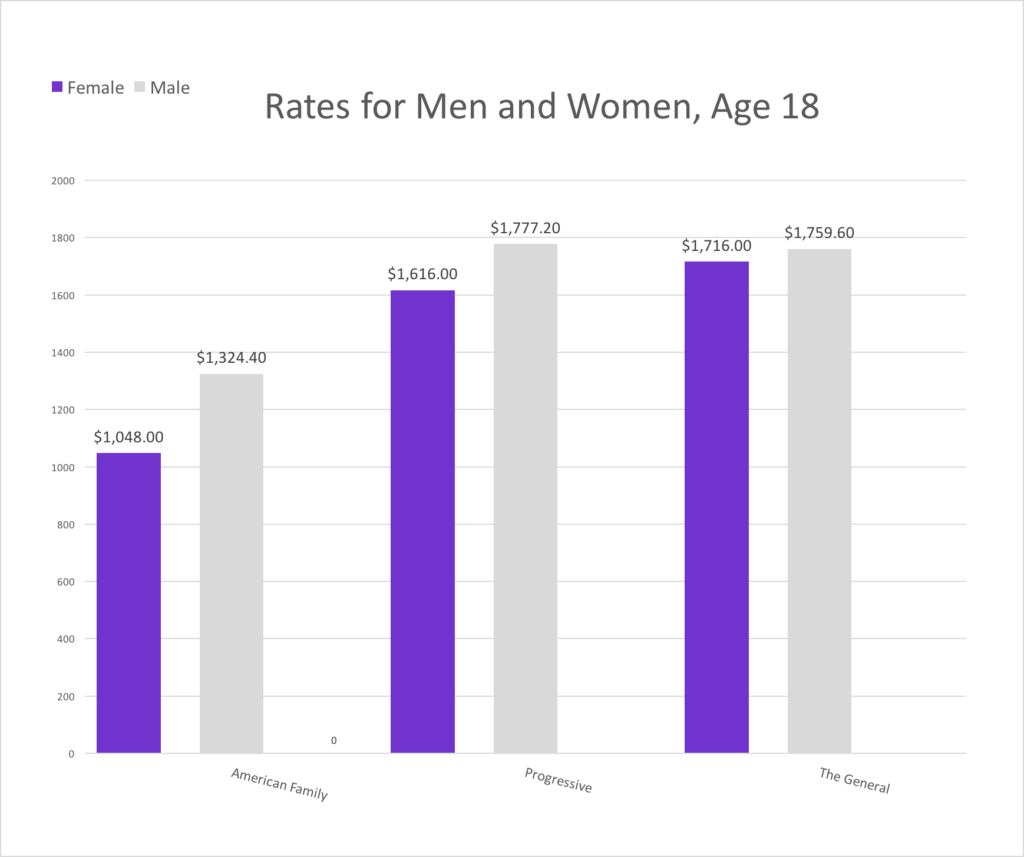

Guys will pay about 22% more for car insurance than their 18-year old female friends. It’s not fair, but based on our research, we found that to be true. For comparative purposes, here are the three cheapest companies based on average rates for both male and female 18-year olds.

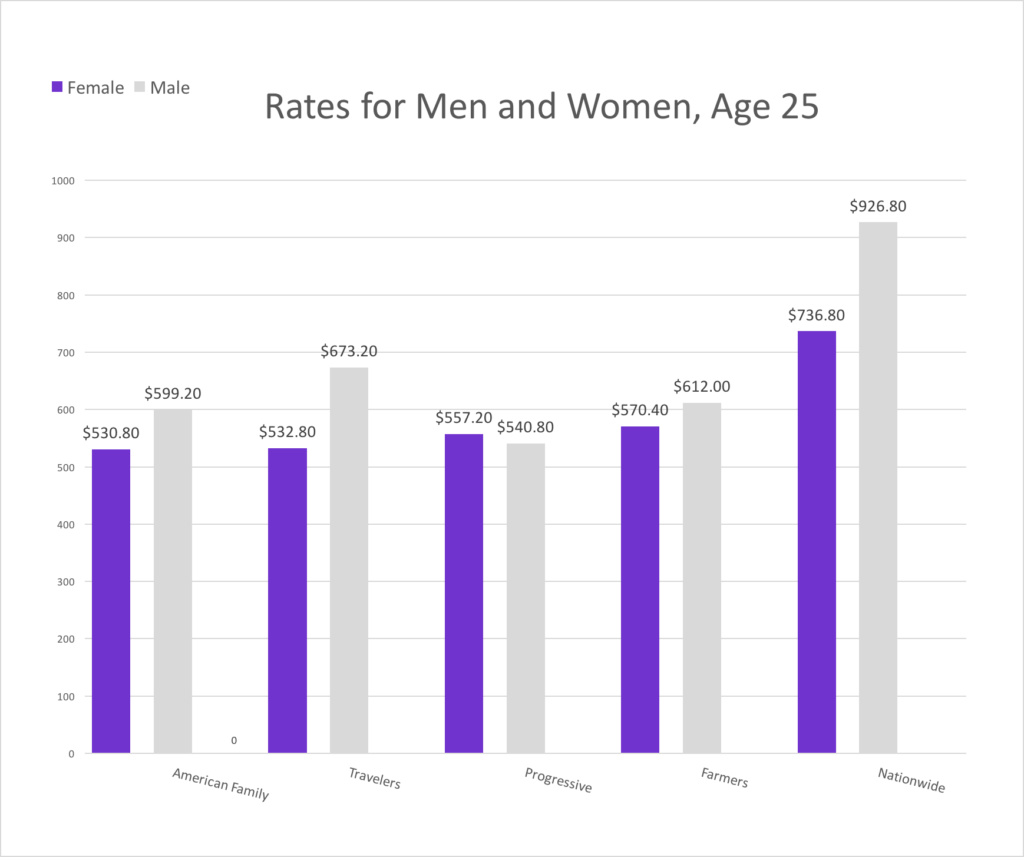

Men still pay more for car insurance than their female counterparts at age 25, but the difference starts to even out at 25. Take a look at the chart below to see the cheapest options out there for you.

What are average rates in the cities?

From Green Bay to Milwaukee, you’ll find a lot of different auto insurance rates. Since the difference is nearly $1,000, you’ll want to take a look so you can see average car insurance premiums that your neighbors might be paying.

| Average Quote | ||

|---|---|---|

| Green Bay | $1,249.29 | |

| Oshkosh | $1,272.46 | |

| Janesville | $1,353.79 | |

| Appleton | $1,401.38 | |

| Eau Claire | $1,535.92 | |

| Waukesha | $1,543.08 | |

| Madison City | $1,556.38 | |

| Racine | $1,556.79 | |

| Kenosha | $1,895.75 | |

| Milwaukee | $2,032.38 |

Read more: Finding Affordable Auto Insurance In Milwaukee

What are the most popular Wisconsin car insurance providers?

Market share measures the percentage of customers a company has compared to competitors. American Family Insurance has the highest market share in Wisconsin nearly 20%. The thing to note is that it’s also the cheapest provider, so it could be a popular choice because of the price tag. Progressive has the second cheapest car insurance rates on average, so people in Wisconsin seem to be going with providers that offer good value on policies. See how popular the car insurance company you’re interested in is by looking at the chart below.

| Premiums Written | Market Share | |

|---|---|---|

| American Family | 522,203 | 19.67 |

| Progressive | 431,256 | 16.24 |

| State Farm | 381,707 | 14.38 |

| Geico | 112,112 | 4.22 |

| Allstate | 110,371 | 4.16 |

| Acuity | 100,477 | 3.78 |

| West Bend Mutual | 80,417 | 3.03 |

| Farmers | 74,968 | 2.82 |

| Liberty Mutual | 68,115 | 2.57 |

| Erie | 57,344 | 2.16 |

What companies have the best customer service?

Complaint indexes report the percentage of customer complaints compared to a company’s market share. Auto Insurance Group and IMT are the best because they have the lowest ratios which means the least complaints.

If customer service is important to you, take a look at the auto insurance providers‘ complain indexes to see how they treat their policyholders.

| Premiums Underwritten in Wisconsin | Complaints | Ratio | |

|---|---|---|---|

| IMT Group Insurance | $16,368,872 | 1 | 0.06 |

| Acuity Insurance | 93,460,957 | 6 | 0.06 |

| USAA | 48,042,819 | 4 | 0.08 |

| Nationwide | 24,018,836 | 2 | 0.08 |

| Rural Mutual Insurance | 29,987,179 | 3 | 0.10 |

| State Farm | 345,617,526 | 39 | 0.11 |

| American Family | 516,824,418 | 65 | 0.13 |

| Wilson Mutual | 20,520,804 | 3 | 0.15 |

| West Bend / Silver Lining Insurance | 75,147,569 | 11 | 0.15 |

| Erie Insurance | 47,280,963 | 7 | 0.15 |

| Safeco | 18,894,666 | 3 | 0.16 |

| Auto-Owners | 44,077,030 | 7 | 0.16 |

| Secura Insurance | 31,032,940 | 5 | 0.16 |

| MetLife | 27,175,663 | 5 | 0.18 |

| Liberty Mutual | 46,479,177 | 9 | 0.19 |

| Progressive | 405,739,408 | 93 | 0.23 |

| Badger Mutual Insurance | 21,036,834 | 5 | 0.24 |

| Wisconsin Mutual Insurance | 37,478,366 | 9 | 0.24 |

| State Auto | 16,292,539 | 4 | 0.25 |

| AAA | 48,783,413 | 12 | 0.25 |

| Pekin Insurance | 27,518,813 | 7 | 0.25 |

| Allstate | 82,458,184 | 21 | 0.25 |

| Hastings Mutual | 16,226,783 | 5 | 0.31 |

| Geico | 99,125,841 | 31 | 0.31 |

| Integrity Insurance | 22,380,259 | 7 | 0.31 |

| Hanover | 15,783,642 | 5 | 0.32 |

| Hartford | 28,261,658 | 9 | 0.32 |

| Farmers | 61,959,328 | 28 | 0.45 |

| Sentry | 24,032,283 | 11 | 0.46 |

What do we recommend?

We have some advice for you: go with a company that’s an all-around stunner. Progressive and American Family Insurance are examples of this because both are the top two for average price and market share and rank well for customer satisfaction.

If you need help finding cheap auto insurance, call a licensed insurance agent. They’ll be able to help you with quotes or questions.

Where We Found The Facts

Everything here was carefully researched and analyzed, but the premiums may not be what you’re quoted for auto coverage. Why? If you don’t match the driver profiles exactly, you’ll get a different premium. We just wanted to show you examples of what people like you pay.

Source Links:

- Wisconsin Department of Insurance

- Ratekick.com